What Do Great Engineering Managers Need To Know About Compensation and Equity?

Learn how compensation and equity are decided at companies, discover an exercise to understand your team's compensation, and find areas for improvement.

Join the DZone community and get the full member experience.

Join For FreeToday we’re going to do a whirlwind tour of compensation. Hopefully, you’ll learn a bit along the way, and I’ll share an exercise for managers called a compensation review.

What Do You Need To Know About Salary?

- The largest expense for engineering organizations is usually salary.

- Salary is mostly determined by supply and demand. Engineers are fortunate to be an industry with high demand. Companies have to compete based on salary and benefits in order to hire good engineers.

Structured Pay and “Pay Equity”

Some companies use structured pay. Structured pay is when there is a “system” for determining pay:

- Pay can be based on the employee level, tenure, specialty, or other factors.

- Most companies have structured pay; some do not.

Structured pay is a spectrum. Most companies end up having some sort of system for pay.

Companies that emphasize fairness and equity also will often implement a more extreme version of structured pay known as "pay equity."

- Pay equity truly uses a formula to determine salary.

- The formula can be based on years of experience, engineering level, or other factors, but it’s determined by a formula.

- Pay equity is less biased, but also less flexible.

- Companies that implement pay equity tend to attract underrepresented employees better. Why? It is a signal that the company tries to pay people in a less biased fashion.

As a manager, you need to know how pay works.

Non-Pay Equity Pay Options

If the company hasn’t implemented pay equity, then you have to figure out how it works. Here are several variants I’ve seen:

- Manager discretion: Managers have the discretion to set pay, based on a budget they can use.

- Manager proposed: Managers propose pay increases, which are approved by their managers or some group.

- Directors or VPs set pay: With input from a manager; using a budget

- Cost of replacement: Compensation increases can be justified based on proving you could make more by going elsewhere. This perversely incentivizes people interviewing outside the company. Netflix is famous for this approach.

Your homework is to figure out how your company’s system works. Is it structured? Is there a formula for how salaries are computed? Do you have salary ranges?

Geo-Based Compensation

Companies have to make a philosophical choice in how they pay. They can choose:

- Geo-blind: Pay the same amount without regard to location. Note: This does NOT mean everyone gets the same salary because taxes and expenses will vary based on location. Some people could end up getting twice the take-home pay!

- Geo-balanced: Pay so that everyone receives the same amount, regardless of where they live. This means the company will pay very different amounts for each employee. For example, costs in one country in Europe can be twice what they are in another country.

- Geo-based: The pay is adjusted based on what compensation people are getting in that location. People in San Francisco get paid more than people in Kansas or Poland.

Each of these has tradeoffs:

- Geo-blind: You’re paying high for regions where pay is on average lower. This makes you more competitive in those locations. Unless you pay a rate high enough you can be competitive in expensive markets, you’re less able to hire people in expensive locations. In practice, this means you’re not hiring out of tech hubs like San Francisco.

- Geo-balanced: You’re more competitive in countries with high taxes, and less competitive in countries with low taxes. Also, you pay more for the employees you’re most competitive to receive, which can be a disadvantage. I believe geo-balanced is a rare choice for companies. Let me know if you are at a company that does this.

- Geo-based: You’re able to hire in expensive markets, where there is a lot of talent and experience to draw from, but you’re also able to save money by hiring outside of those locations at a lower rate. This can incentivize hiring in less expensive locations, but you face more competition in those locations from companies that are geo-blind. Often the best candidates in those regions will look for geo-blind positions because their pay can be so much higher. You also have to figure out your approach to having people move between locations. Do you change their pay?

People tend to be pretty ideological about which of these is best, but the important thing is you need to understand how it works at your company.

You May Not Be Able To Hire Everywhere, Because Taxes

Most companies will have a list of locations from which you can hire. The reason for this is that companies have to do paperwork and taxes for every location they have employees, and sometimes there can be additional legal ramifications for having a “presence” in a location.

There are companies that help minimize the overhead of this, but it’s still an issue, so you need to be aware of the locations of your team members.

Because of these factors, an employee moving to a new location can be a “problem” you have to work through with your People Ops/HR team. You may not be able to hire people everywhere you think you can, so consult with your People Ops team when hiring.

Generally, companies will be willing to incur the overhead for existing employees, but there are times companies will cut ties with an employee rather than deal with additional legal requirements.

Note that the differences between locales are very different between regions within a country, and between countries. The burden of dealing with international relocation, visas, and taxes can be so large that many companies will not bother to address them.

Budgets and Pay

Finance usually provides a budget to each department. Depending on the size of your company, you may or may not have much interaction with the budget. However, even if you don’t know it’s there, the budget is a hidden force that drives a lot of decisions.

Companies generally have a certain amount of money they can spend on hiring employees, promotions, and cost of living adjustments. Usually, that pool of money is determined by Finance. That pool of money for employee salaries can be divided into buckets such as “salary,” “promotions,” and “cost of living adjustments,” but it may not be.

Generally, budgets are zero-sum. If you give more raises, you hire less. If you give a larger cost of living adjustment, you promote less.

You’ll see a lot of people that talk about how things “should be,” but the reality is that this is how it works in most companies. You can sometimes get exceptions, but the money has to come from somewhere.

One thing to be aware of is that saving money somewhere can often justify spending it elsewhere. As a frontline manager, you probably won’t be in a position to be making a lot of these decisions, but understanding how it works can help you if you want to advocate for change.

How Companies Determine Compensation

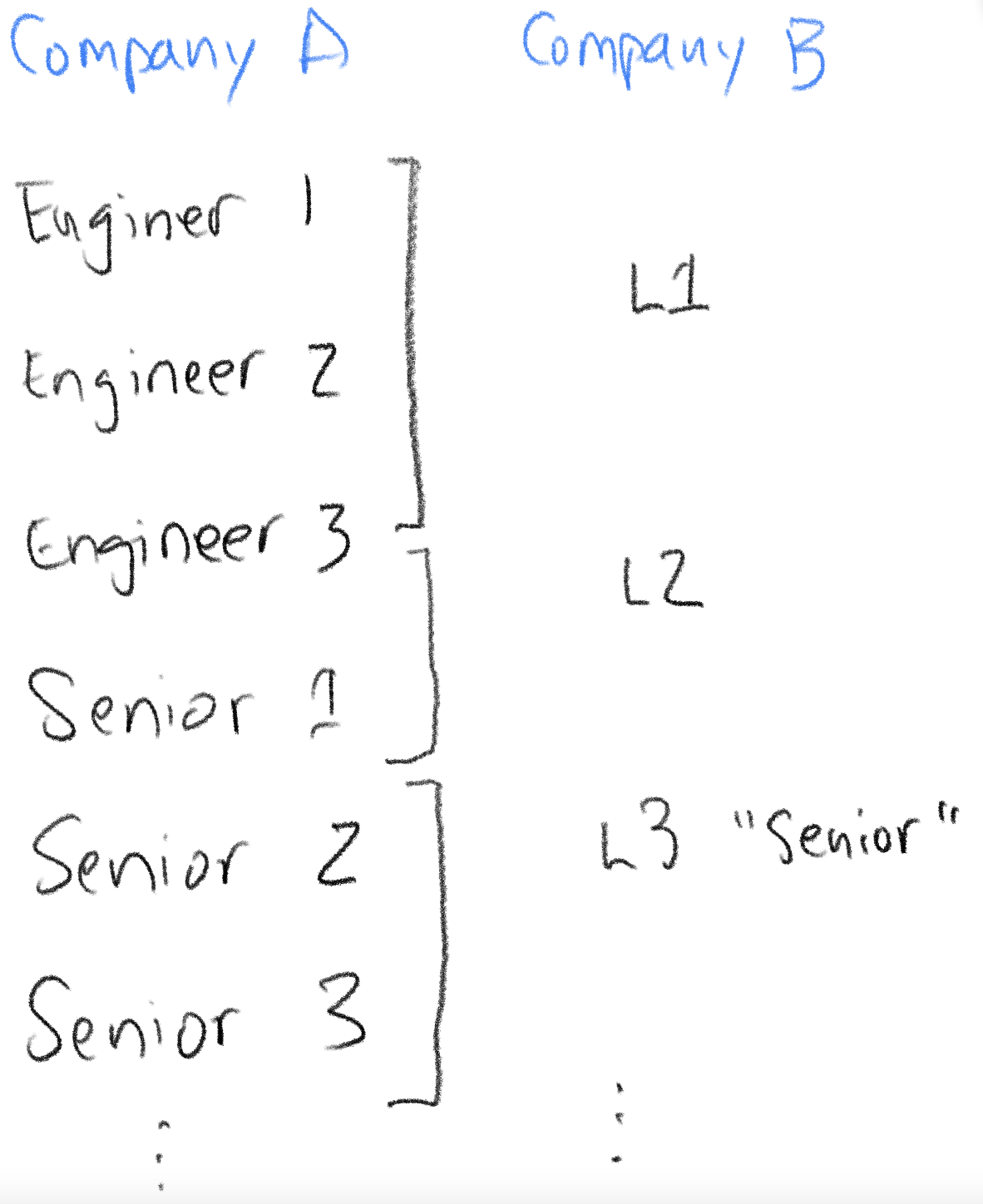

Most companies have engineering “ladders.” These describe the difference between a software engineer and a senior software engineer, and they outline the criteria for advancement between these levels.

Companies do this for a number of reasons. What you’re probably familiar with is their use to help guide career discussions, and to attempt to create an objective standard you can make promotion decisions around.

What you may not realize is that companies use these ladders for another purpose: they use them to determine salary. You may think, “of course they do," but there are companies out there that provide salary information. By creating a ladder, and defining what is in that ladder, your HR people can match up your company’s levels to what is done for the whole industry.

This is complicated because engineering titles are not equivalent across companies. A senior engineer at Company X does not equal a senior engineer at Company Y. These companies have detailed ways you can map your titles to theirs.

Many companies also use salary tools, which attempt to compute a salary based on a job description and a bunch of keywords. These tools aren’t perfect, but they are an attempt to use data to make sure compensation is fair.

Larger companies will have a dedicated compensation person. Their job is to determine compensation for all the roles in the company.

Pay Percentiles

Companies generally target a “percentile” when choosing what salary to pay. You might hear a People Ops person say something like, “We target the eightieth percentile for salaries."

What this means is that in each market you’re competing in, you’ll use data to determine the salary ranges. You’ll use the distribution of salaries to determine what to set the salaries you offer.

For companies that are not geo-based, this means you’re competing in a global market. Many geo-blind and geo-balanced companies don’t attempt to compete in expensive markets like San Francisco, because that means they’re paying a very high rate for employees everywhere.

Pay Tradeoffs

Compensation is a set of tradeoffs that companies make. They have to juggle business needs, market conditions, the employee experience, and growth and performance management.

For example, a company can offer a higher salary, but not promote its employees as quickly; or, it can choose to give more money for promotions, but not be able to hire as many people. And, of course, each company chooses what budget to make available for hiring and promotions.

These factors are invisible to most people. But they explain why you see things like a low promotion budget, but rapid hiring. They’re optimizing to bring more people in, but trading that off against future employee turnover.

Equity

The definitive guide to equity compensation is the Holloway Guide to Equity Compensation. I recommend you read it carefully. You’ll need to have conversations with your team about equity, and understand it is beneficial in its own right.

A couple of things to remember:

- For startups, the value of a share of stock changes over time (hopefully it rises). When the company is younger, equity will be “inexpensive.” As the company succeeds, the value of the company will increase, so each share will have a higher value.

- It’s inexpensive early on because it’s risky.

- Because of this, earlier stage employees get more equity. This reflects the additional risk they take on joining a company. Many companies don’t make it, so the earlier you join, the higher the risk; but also, the higher the reward.

- The typical pattern for startups is for early employees to have lower salaries, but lots of equity. The discounted salary is somewhat offset by the large equity grant. As the companies grow, they usually correct these discounts as options vest.

- To make it more confusing, companies also issue different types of equity. ISOs, NSOs, RSAs, and RSUs are all different.

- Comparing equity becomes complicated quickly.

Why Do a Compensation Review?

Now let’s talk about the compensation review exercise. Here are the benefits:

- It will help you understand and support your team better.

- You’ll probably find some errors, and correcting those errors will earn you goodwill.

- It forces you to learn about compensation and equity, which will be good for your team, and for yourself.

Are You Even Able To Do a Review?

But before we start, let’s make sure you can do such a review.

- Do you have access to your team’s salary? Can you just look it up, or do you have to ask for it? In most companies, you’ll have access to look it up, but sometimes you can get it by request. In some companies, it’s not available to you; if so, you won’t be able to do this exercise.

- Do you have access to your team’s equity? In some companies, even if you have access to salary, you may not have access to equity. If you do, you may not have access to full information about that equity. That’s fine, but keep in mind equity is complicated.

Doing the Compensation Review

Doing the review is actually pretty simple. I have a template you can copy and adapt for your purposes. Fill it out for every member of your team. Highlight in red the things that stick out as most problematic.

Tips When Doing a Compensation Review

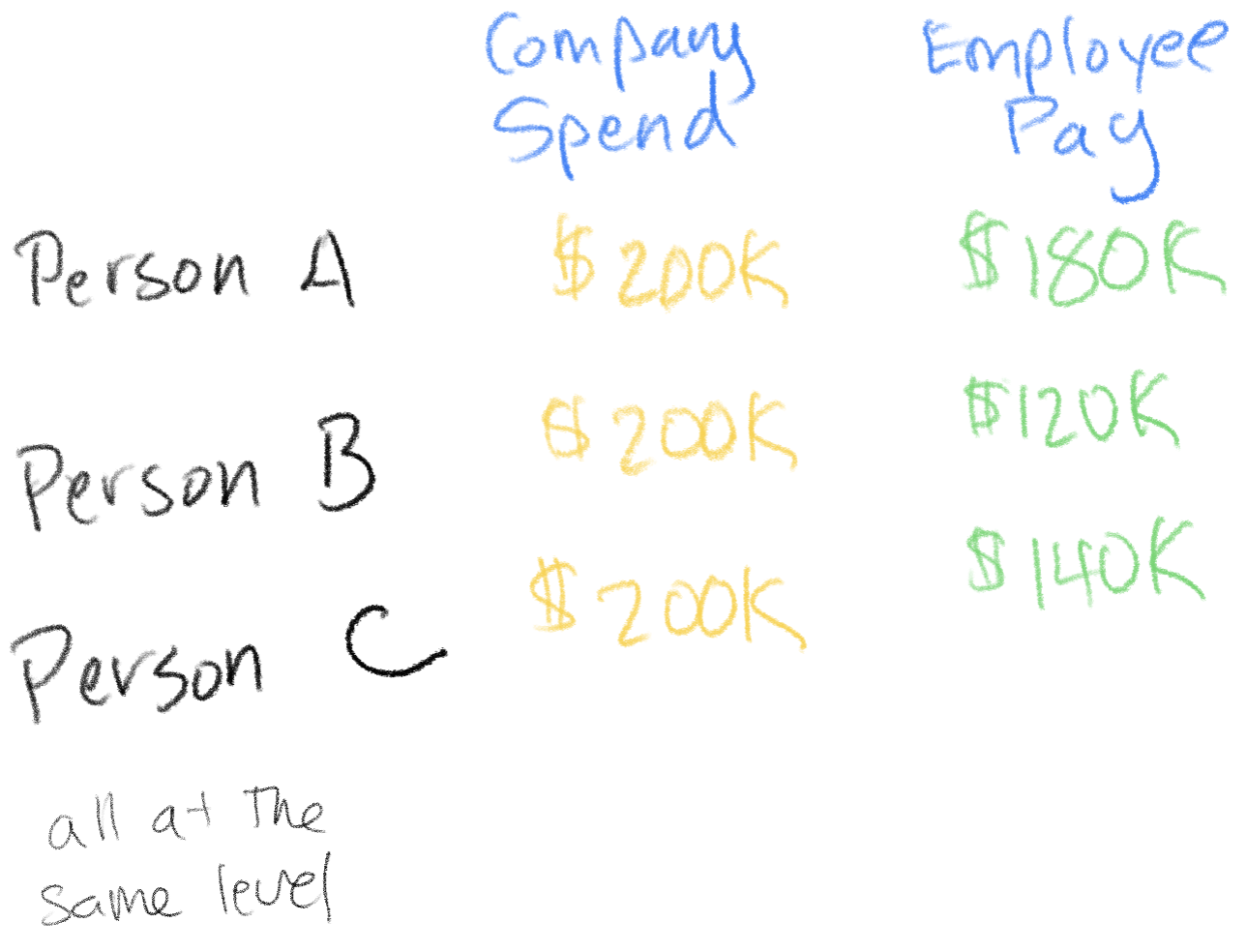

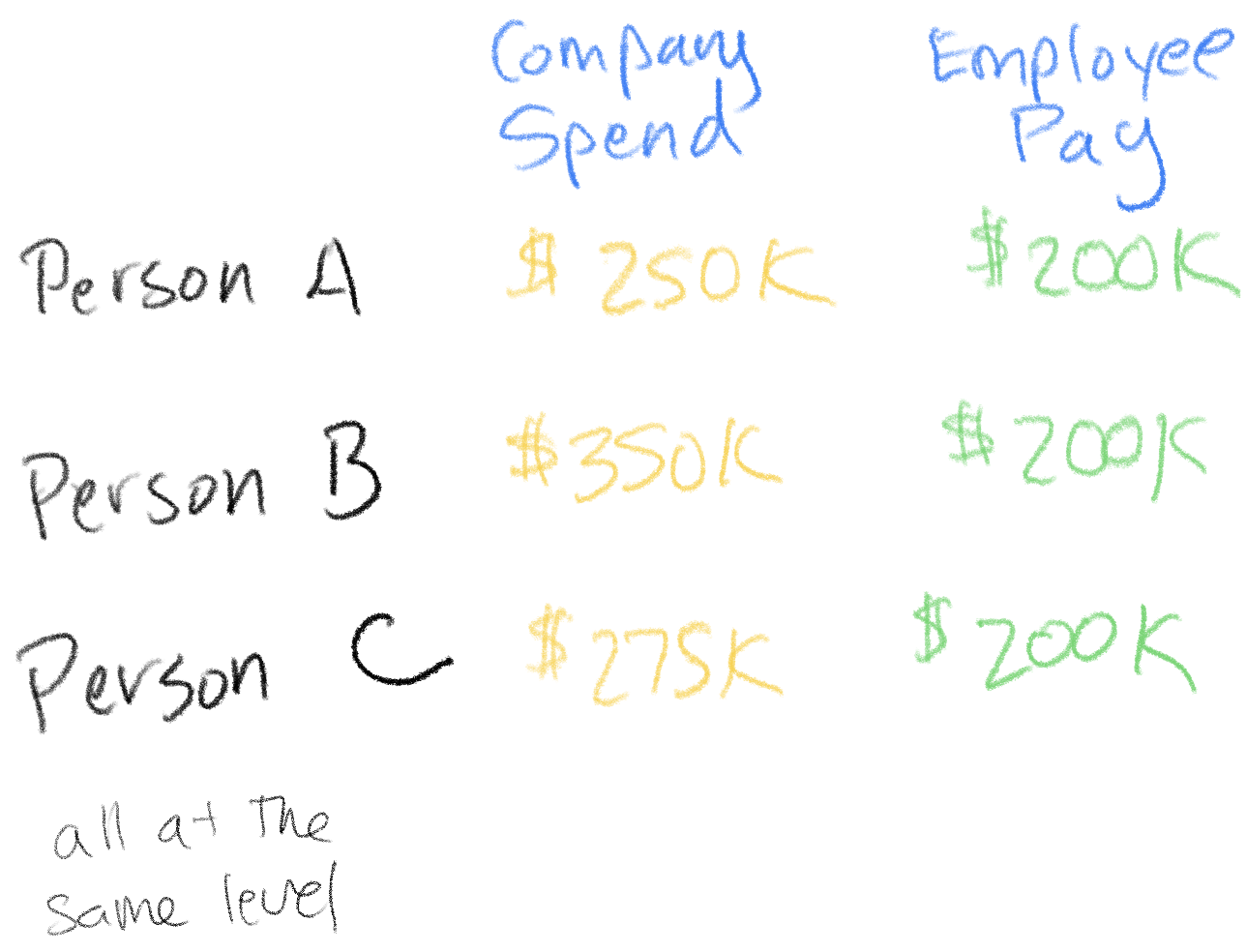

- Look for salaries that seem lower than they should be. Compare to people at the same level, one level below, and one level above.

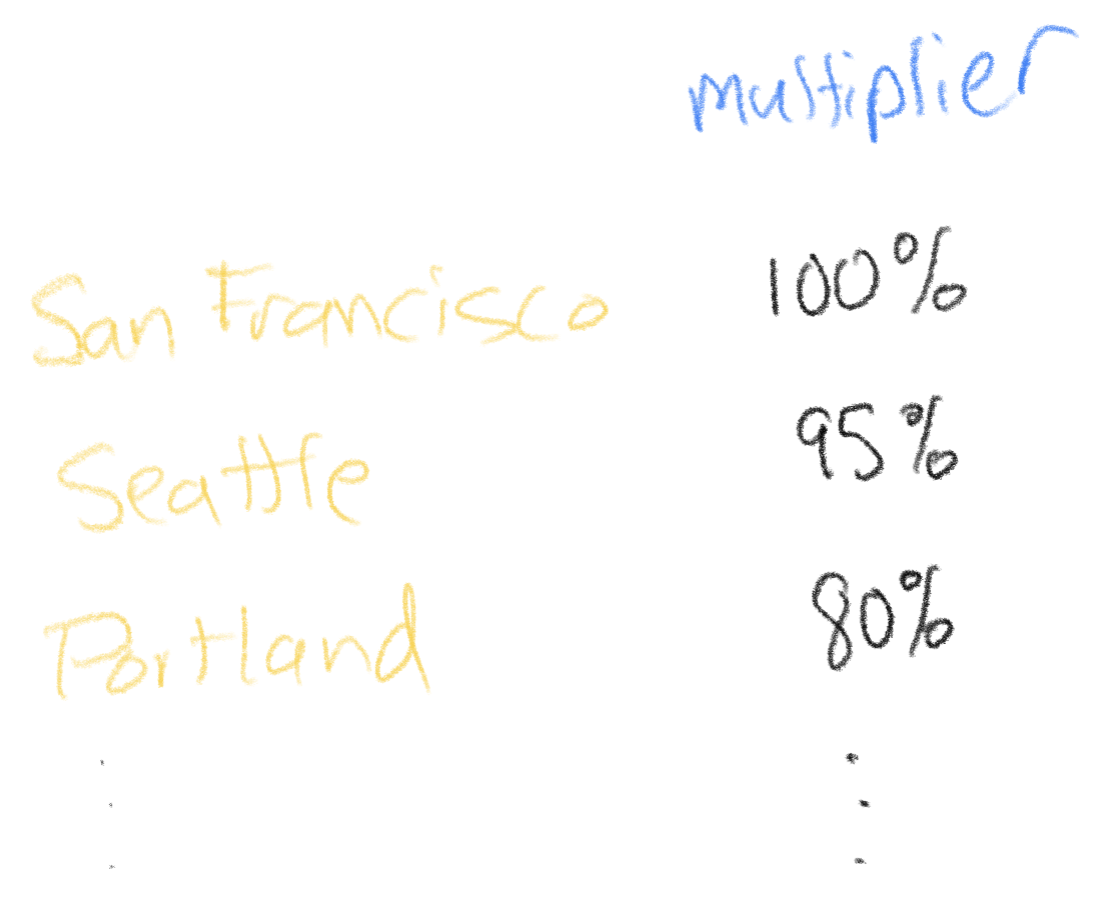

- If your company does geo-adjustment, you’ll need to figure out how it works, and factor that in. Usually, it is a multiplier on the salary. For example, 100K * (geo-adjustment of 90%) = 90K. Companies will usually have a table of locations, or use a tool that produces the geo-adjustment. I like to produce a “geo-reversed salary,” but doing so will require you to know how the geo adjustment works.

- If you’re not able to find how geo-adjustment works, you can estimate using a cost of living calculator to get a ROUGH idea. This is highly imperfect because the cost of living is not how these geo adjustments are determined. They are determined by supply and demand.

- In the notes section, fill out anything interesting. For example, I’ve worked at a couple of startups that gave early employees the option to tilt their compensation towards equity or salary.

Look for edge case scenarios:

- If they were rehired into their position, would they get a raise?

- If they were rehired into their position today, would they have more unvested equity?

- Do a pass for fairness. Is everyone being paid fairly for their level?

What Do You Do Now?

Once you’ve done the compensation review, you’ll probably notice a few things that seem off. Your next job is to dig into that. Are there legitimate reasons for those anomalies, or are they something that needs to be fixed? Make these changes as quickly as possible.

Published at DZone with permission of Jade Rubick, DZone MVB. See the original article here.

Opinions expressed by DZone contributors are their own.

Comments