Financial Data Engineering in SAS

Data Engineering is an art and, if mastered, can pave the way to more interesting observations in the field of finance and data analytics

Join the DZone community and get the full member experience.

Join For FreeFinancial data engineering in SAS involves the management, processing, and analysis of financial data using the various tools and techniques provided by the SAS software suite. Here are some key aspects of financial data engineering in SAS:

1. Data Import and Export

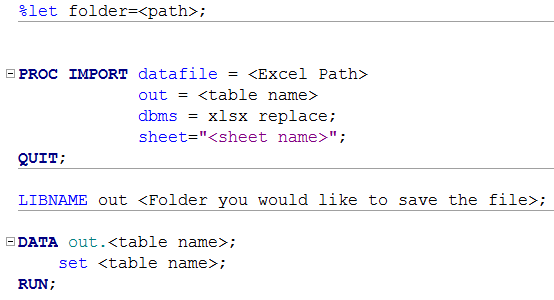

Use PROC IMPORT and PROC EXPORT procedures to read and write financial data from and to various file formats such as CSV, Excel, and databases.

Most of the financial data is huge and often times it takes a lot of time to import. One good methodology I found useful is to import the file to SAS once and save it as .sas7bat file in a folder. Every time you run the same analysis, we can point to that folder and import the data.

2. Data Cleaning and Validation

Employ SAS data manipulation techniques, such as the DATA step and PROC SQL, for cleaning and validating financial data. This includes handling missing values and outliers and ensuring data consistency.

Financial data often include inconsistent data, which will not be useful for further analysis. For example, there might be trade entry without the price. The price for a particular trade will be significantly different from other trades.

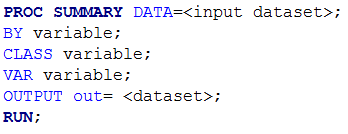

PROC MEANS/ PROC SUMMARY step plays a pivotal role in identifying the irregularities in the data. A simple description of statistics and a box plot is used to identify outliers in the data which may cause our analysis to fall apart.

In the above example, we can see the descriptive statistics by the number of variables across the input datasets and visualize if the statistics make sense.

3. Data Transformation

Utilize the DATA step and other SAS procedures for transforming financial data. This may involve aggregating data, creating derived variables, and handling time series data.

Identifying which data requires transformation involves how effectively you were able to perform data validation. If you find some opportunities where aggregating the columns would prove more effective, e.g., financial metrics of the retail stores having address, county, and zip code as separate columns, it will make more sense to combine it all into one column and label it as address.

Most of the regression techniques involve modifying the price to calculate the log of it to calculate the returns. In such cases, we can derive a new column called “Log Price” from the “Price” column.

The most used transformation techniques in SAS for Finance are as below,

4. Time Series Analysis

SAS offers specialized procedures for time series analysis, such as PROC TIMESERIES and PROC REG, which can be used to analyze financial time series data, perform forecasting, and identify trends and patterns.

As with any other programming language, SAS offers unique packages and tools to perform regression and statistical analysis.

The TIMESERIES procedure forms a time series from the input time-stamped transactional data. It can provide results in output datasets or in other output formats by using the Output Delivery System(ODS). Time-stamped transactional data are often recorded at no fixed interval. Analysts often want to use time series analysis techniques that require fixed-time intervals. Therefore, the transactional data must be accumulated to form a fixed interval time series. Suppose that a bank wants to analyze the transactions associated with each of its customers over time. Further, suppose that the dataset WORK.TRANSACTIONS contains four variables that are related to these transactions: CUSTOMER, DATE, WITHDRAWAL, and DEPOSITS.

To accumulate the time-stamped transactional data to form a daily time series based on the accumulated daily totals of each type of transaction (WITHDRAWALS and DEPOSITS), the following TIMESERIES procedure statements can be used.

The OUT=TIMESERIES option specifies that the resulting time series data for each customer is to be stored in the dataset WORK.TIMESERIES. The INTERVAL=DAY option specifies that the transactions are to be accumulated on a daily basis. The ACCUMULATE=TOTAL option specifies that the sum of the transactions is to be calculated.

SAS provides tools for building financial models. The PROC MODEL procedure, for example, allows users to build and estimate econometric models.

5. SAS Macros and Automation

Leverage SAS macros to automate repetitive tasks and streamline financial data processing. Macros can be used to parameterize code and enhance efficiency.

This proves to be one of the most complicated and effective tools for performing iterative analysis involving huge amounts of data.

SAS macros tend to fall into one of two general groups: function macros and statement macros. Function macros tend to emulate SAS numeric or string functions. It may return a single or group of variables as output.

A SAS macro is defined using the %macro statement, followed by the macro name. The definition begins with %macro and ends with %mend.

5.1 Macro Variables

Macro variables are used to store and pass values within a macro. They are created using the %let statement.

5.2 Macro Parameters

Macros can accept parameters, allowing them to be more versatile. Parameters are specified within parentheses after the macro name.

5.3 Macro Execution

Macros are invoked using the %macro_name syntax.

%MACRO <macro_name>;

<code>

%MEND;

As stated above, MACRO always starts with %MACRO and ends with %MEND.

5.4 Conditional Processing

%if, %then, %else, and %endif statements can be used for conditional processing within macros.

5.5 Macro Loops

%do, and %end statements can be used for creating loops within macros.

SAS macros provide a powerful way to make code more efficient, reusable, and adaptable. They are commonly used in data manipulation, reporting, and other areas where automation and parameterization are beneficial.

It plays a pivotal role in Financial Engineering in terms of analyzing the performance of any stocks in the index. For example, if we have a generalized code to perform regression on any particular stock and are also interested in plotting graphs, we can generalize it in macro and call the macro every time by changing only the stock ticker when we call the MACRO.

6. Conclusion

Remember that the specific tools and procedures you use in SAS for financial data engineering will depend on the nature of your financial analysis tasks and the requirements of your organization. Additionally, staying updated with the latest SAS software features and capabilities is essential for effectively leveraging SAS in the field of financial data engineering. Continuous learning and adapting yourself to modern trends will make you an efficient Financial Engineer and could help see through the data, which is the most essential skill any organization would love to have.

Opinions expressed by DZone contributors are their own.

Comments