Using Big Data and Predictive Analytics for Credit Scoring

Learn how data is analyzed and boiled down to a single value — a credit score — using statistical, machine learning, and predictive analytics techniques.

Join the DZone community and get the full member experience.

Join For Free"Buy now, pay later" is a tempting offer made by many financial and retail firms to their customers to increase their customer base. However, both parties need to be aware of the risks when making such credit decisions. It is important for both the lender and the customer that the customers will be able to honor the credit obligation and pay back what is owed for the purchase by the end of the loan term. Lenders need to be able to assess the risk of default for each customer so the lender can decide to whom the offer should be granted.

What Is a Credit Score?

Advances in technology have enabled financial lenders to reduce lending risk by making use of a variety of data about customers. Using statistical and machine learning techniques, available data is analyzed and boiled down to a single value known as a credit score representing the lending risk. This value can help guide the decision process. The higher the credit score, the more confident a lender can be of the customer's creditworthiness. Credit scoring is a form of artificial intelligence based on predictive modeling that assesses the likelihood of a customer defaulting on a credit obligation, becoming delinquent or insolvent. The predictive model "learns" by utilizing a customer's historical data together with peer group data and other data to predict the probability of that customer displaying a defined behavior in future.

The greatest benefit of credit scoring is the ability to help make decisions in a fast and efficient way, such as to accept or reject a customer or increase or decrease loan value, interest rate, or term. The resulting speed and accuracy of making such decisions have made credit scoring the cornerstone in risk management across sectors including banking, telecom, insurance, and retail.

Credit Score Types and Customer Journey

Credit scoring can be utilized throughout the customer journey, spanning the entire customer experience during the length of the relationship between a customer and an organization. Although primarily developed for credit risk departments, marketing departments can also benefit from credit scoring techniques in their marketing campaigns (Figure 1).

As depicted in Figure 1, different credit scores are utilized at different stages of the customer journey:

- Application score assesses the risk of default of new applicants when making decisions on whether to accept or reject the applicant.

- Behavioral score assesses the risk of default associated with an existing customer when making decisions relating to account management such as credit limit, over-limit management, new products, and the like.

- Collections score is used in collections strategies for assessing the likelihood of customers in collections paying back the debt.

Figure 1: Credit scores throughout the customer journey

Credit Risk Scorecards

Over the years, a number of different modeling techniques for implementing credit scoring has evolved. They range from parametric to non-parametric, statistical to machine learning, supervised to unsupervised algorithms. The most recent techniques include highly sophisticated approaches utilizing hundreds or thousands of different models, various validation frameworks and ensemble techniques with multiple learning algorithms to obtain better accuracy.

Despite such diversity, there is one modeling technique that stands out: the Credit Scorecard model. Usually referred as Standard Scorecard, it is based on logistic regression as the underlying model. Compared to other modeling techniques, this method ticks many of boxes, making it the favored approach among practitioner — it is used by nearly 90% of scorecard developers. A scorecard model is easy to build, understand, and implement and is fast to execute. As a statistical/machine learning hybrid, its prediction accuracy is comparable to other more sophisticated techniques and its scores can be directly used as probability estimates and hence to provide direct input for risk-based pricing. This is critical for lenders that comply with the Basel II regulatory framework. Being very intuitive and easy to interpret and justify, scorecards are mandated by regulators as the exclusive credit risk modeling technique in some countries.

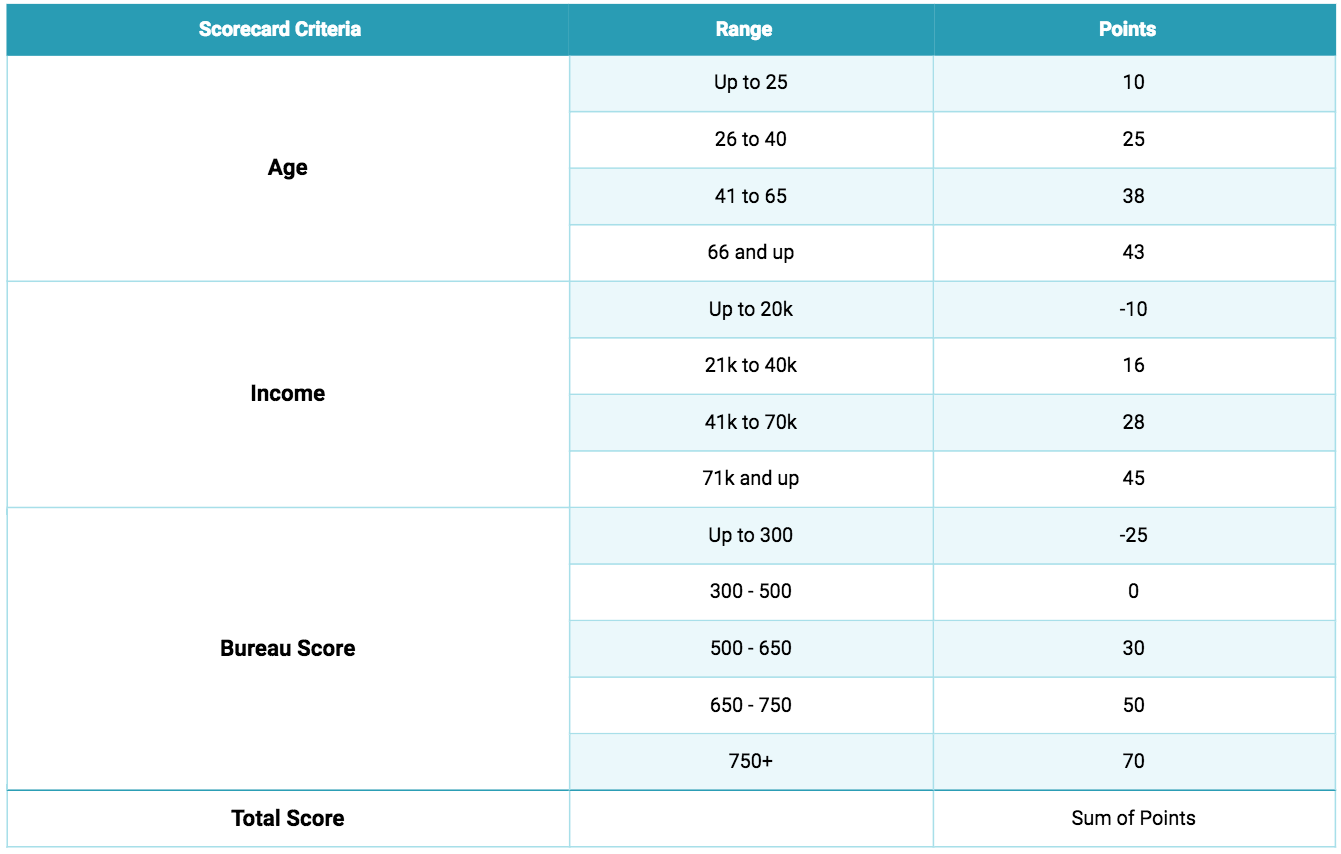

A scorecard model result consists of a set of attributes (customer characteristics) typically displayed in tabular form (Figure 2). Within an attribute, weighted points (either positive or negative) are assigned to each attribute value in the range and the sum of those points equals the final credit score.

Figure 2: Standard Scorecard format

To be continued...

Published at DZone with permission of Natasha Mashanovich, DZone MVB. See the original article here.

Opinions expressed by DZone contributors are their own.

Comments