Tips for Building a Scalable Payment Architecture

A scalable payment architecture requires integrating multiple providers, creating abstractions, using adapters, modularizing UIs, and asynchronous processing.

Join the DZone community and get the full member experience.

Join For FreeWhen you are preparing your application for release, an efficient initial strategy is to integrate a single payment service. But as your application's market reach grows, so does the necessity for flexible and diverse payment options. Having a diverse payment system is crucial to avoid vendor lock-in, to leverage local payment methods, and to maintain control over costs.

That’s why it is important to have a scalable infrastructure that will allow you to accommodate those needs — especially nowadays, when integrating with payment services has become more accessible than ever.

In this article, I am going to share an outline of an architectural framework designed for global expansion. It’s going to be well-equipped to handle diverse market needs and scalable enough to grow with your user base.

Before we begin, I would like to explain some terms that will be used in this article.

Payment Service Provider (PSP): A payment provider is a company that helps businesses accept electronic payments easily and securely. They normally support a variety of payment methods, such as credit cards, direct debits, bank transfers, and real-time transactions using online banking systems. They offer flexible and seamless service for many businesses under a single merchant account.

Payment Network: A payment network is a system that transfers funds from a payer to a recipient, typically involving financial institutions like banks. These networks are essential for the execution of most electronic payments, such as credit card transactions, wire transfers, and electronic funds transfers.

Some examples are:

- Visa and MasterCard

- SWIFT (Society for Worldwide Interbank Financial Telecommunication)

- ACH Network (Automated Clearing House)

- SEPA (Single Euro Payments Area)

- Alipay and WeChat Pay

Payment Method: The term “payment method” refers to how a payment is made by a consumer to a seller for goods or services. It encompasses various instruments or mechanisms used to settle a financial transaction. Payment methods can vary widely and include both traditional and emerging options.

Here are some common examples:

- Cash/check

- Credit and debit cards

- Bank transfers

- Mobile payments

- Online payment services such as PayPal, Stripe, and Alipay

- Cryptocurrencies

Establishing a North Star for Your System

When building a payment solution, these are the goals that ideally need to be achieved:

Not Depending on a Single Payment Provider

This approach ensures flexibility and mitigates risks associated with provider outages, service disruptions, or policy changes. It enables the business to maintain continuous payment operations under various circumstances.

Market Flexibility

This strategy enables adaptation to local preferences and regulations on different markets, offering relevant payment options. It provides familiar and convenient payment methods and can also respond dynamically to shifts in market trends or emerging payment technologies. This largely enhances customer satisfaction and elevates the number of successful purchases.

Good User Experience

To improve and maintain customer satisfaction and trust, the payment process must be smooth, intuitive, and secure. This can be achieved through minimizing payment steps, providing clear instructions, and ensuring high transaction success rates.

Scalability

Adapting your application payment system for handling varying transaction volumes without compromising performance or reliability is essential when you start to add new markets or payment options. This usually requires designing the system in a modular way to allow independent scaling of components such as the user interface, transaction processing, and data storage. On top of that, your app should efficiently manage resources and maintain optimal system performance to achieve desirable scalability.

Scalable Architecture Framework

Following these steps, which can be iteratively applied and refined, will pave the way towards constructing a scalable payment solution. This process ensures continuous improvement and adaptation, and will ultimately lead to an efficient system capable of meeting market demands for your growing business.

1. Create Abstractions Early

While it may seem like an unnecessary complexity at first, creating a level of abstraction early in the development process often requires minimal effort yet brings significant benefits. The goal is to maintain a separation between the structures of the payment provider's APIs and your app’s.

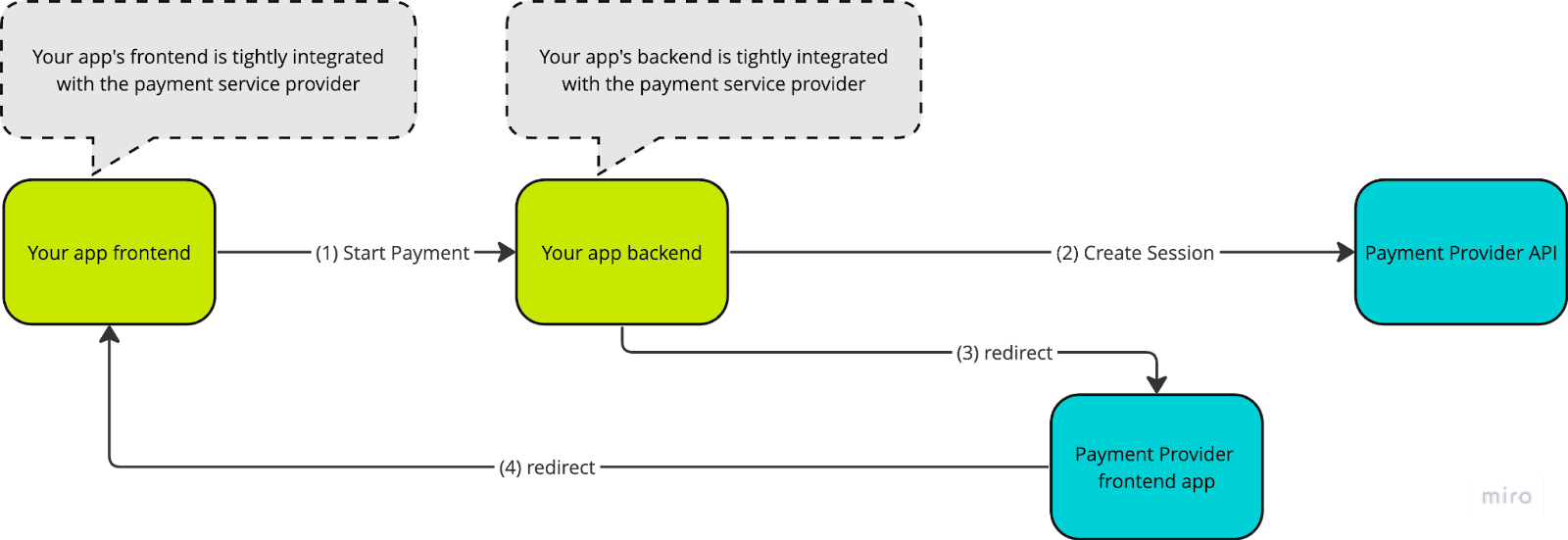

A straightforward approach involves redirecting users to the payment provider's frontend application to complete their transaction, after which they are redirected back to your frontend upon payment completion, whether successful or not.

However, this approach can lead to both your frontend and backend becoming closely intertwined with the payment provider's requests and responses, making it challenging to decouple them later in the development process.

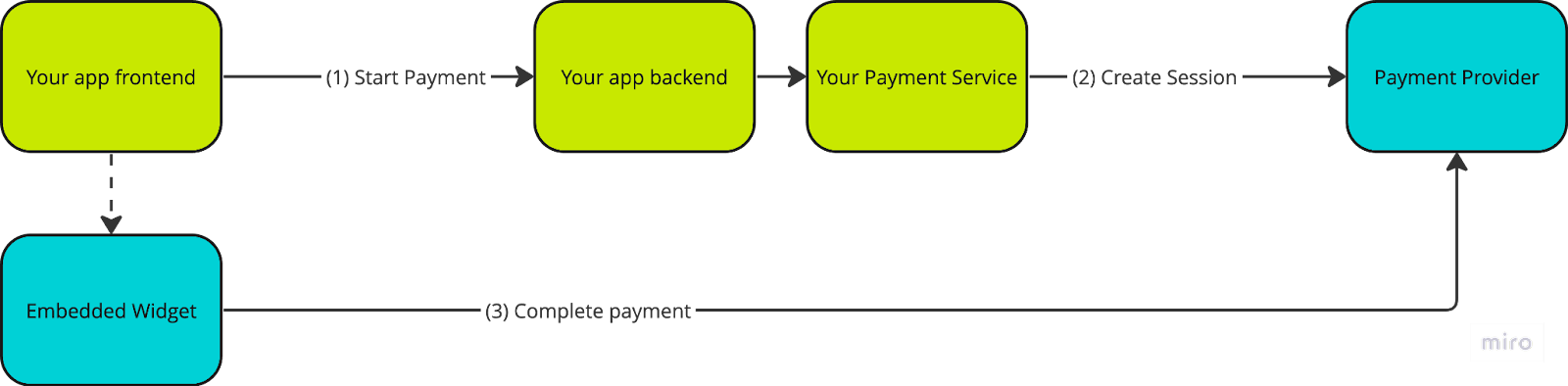

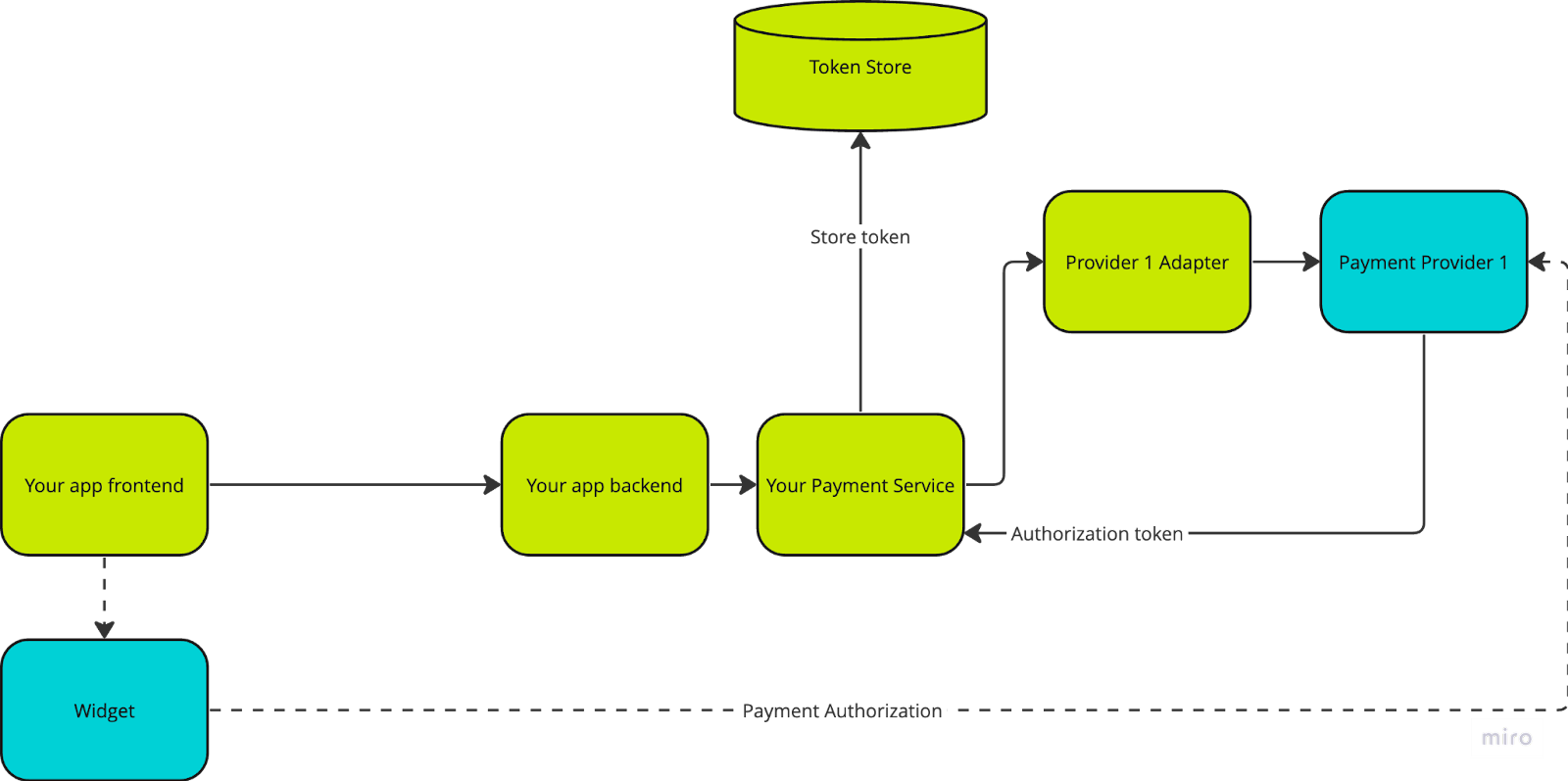

The initial step involves establishing your dedicated payment service. This service will function as the primary point of contact for your app's backend, handling all payment-related operations. This approach centralizes payment processing, providing a streamlined and efficient mechanism for managing transactions within your application.

Most payment providers have an option to use embedded widgets. This makes it easier to decouple your frontend from the payment frontend. Your frontend will still need to perceive the response from the payment provider widget — for that, an abstraction needs to be created as well. This is shown in the next steps.

2. Use Adapters

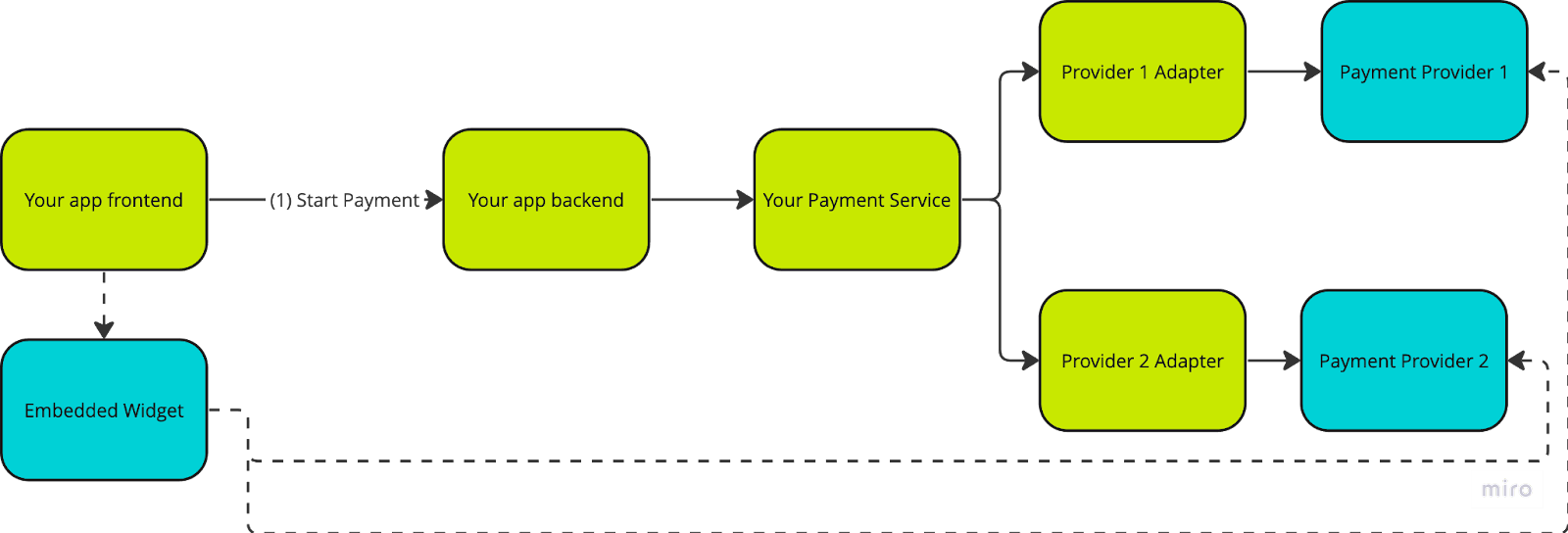

Before integrating with payment providers, you need to develop adapters. This step requires some refactoring, but having the appropriate abstraction layer beforehand makes the process straightforward. Adapters act as translators between your service and the payment provider. Therefore, the adapter is the only component that needs to be aware of both entities.

Implementing an adapter can simplify your payment service and provide the flexibility of configuring each payment provider separately. This way, you can maintain simplicity and flexibility in your payment service without overcomplicating it.

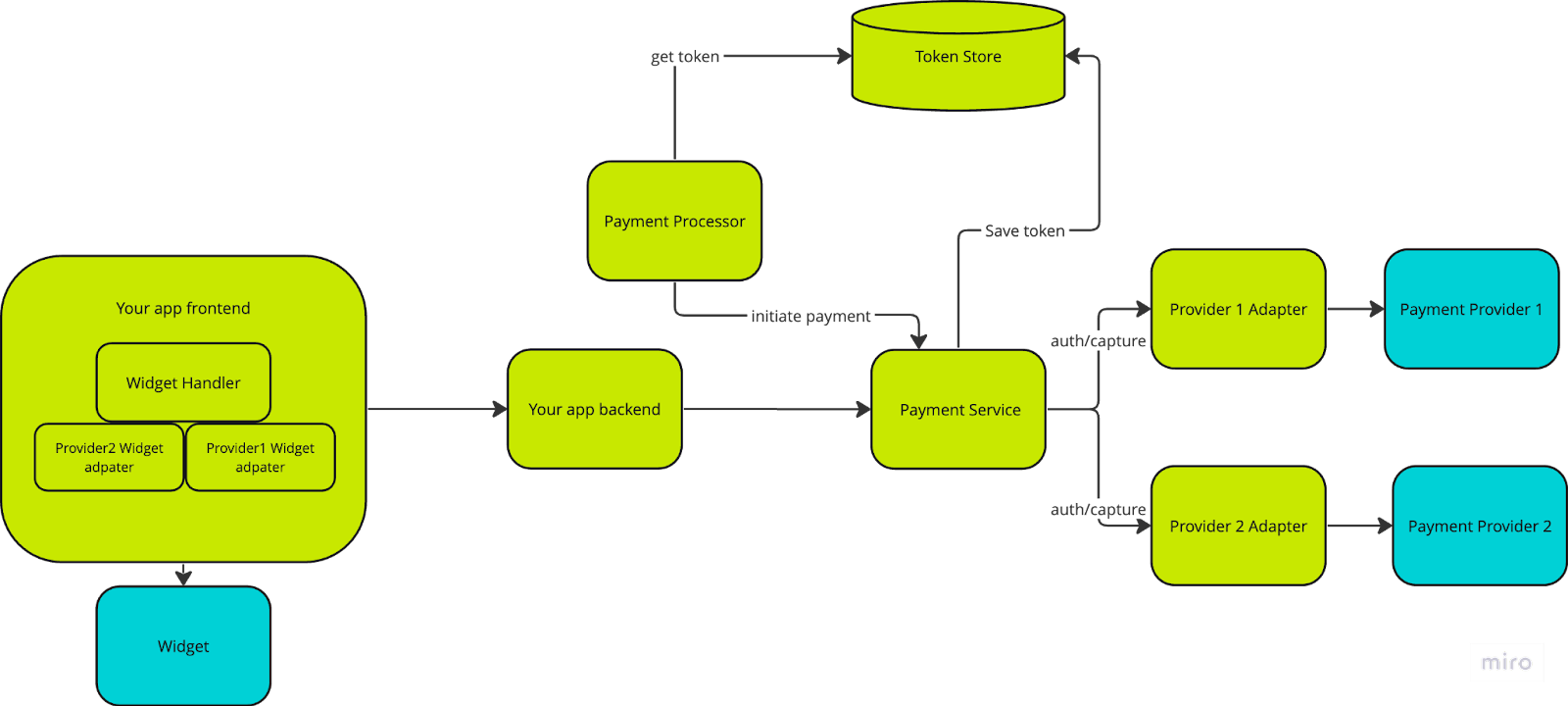

3. Separate Payment UI Modules

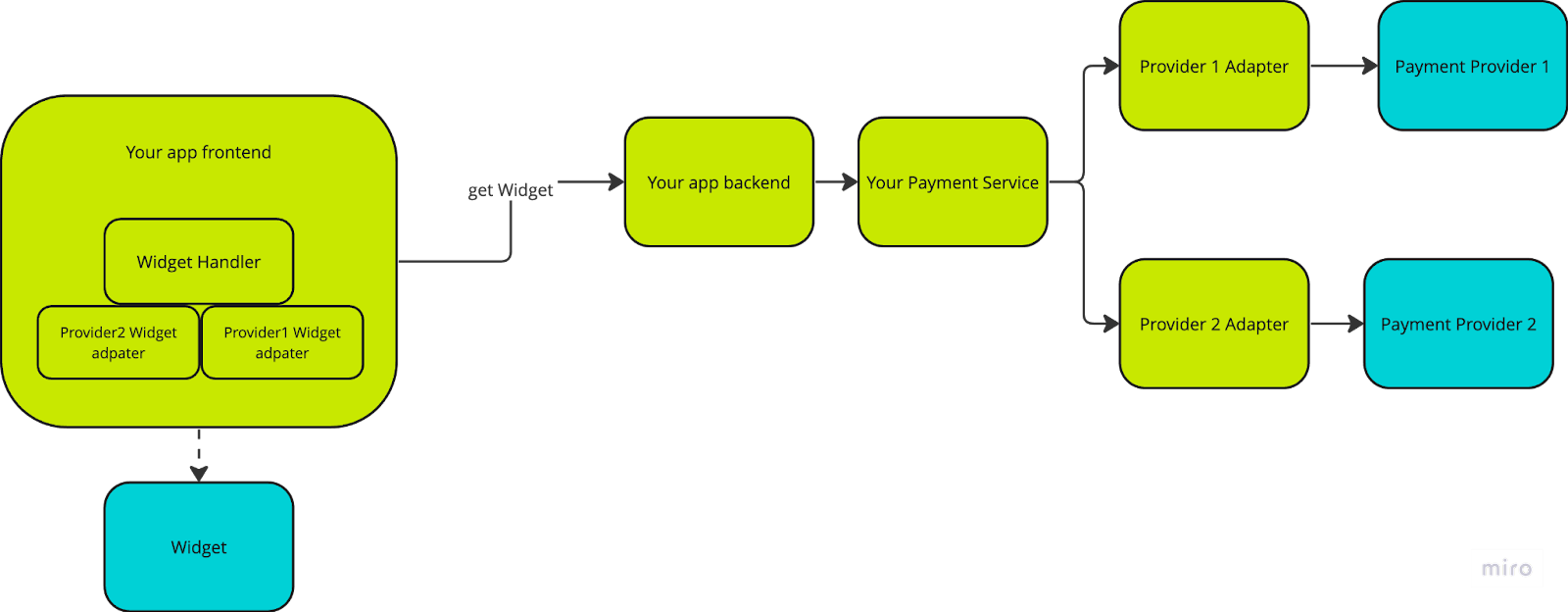

Upon integrating adapters into the backend, your frontend will still need to have knowledge of multiple payment providers. To enhance the setup, consider making the frontend more modular. Implement a universal widget handler that dynamically loads the appropriate widget adapter during runtime.

This approach adds to seamless communication with the widgets provided by different payment service providers and helps make your frontend architecture more adaptable.

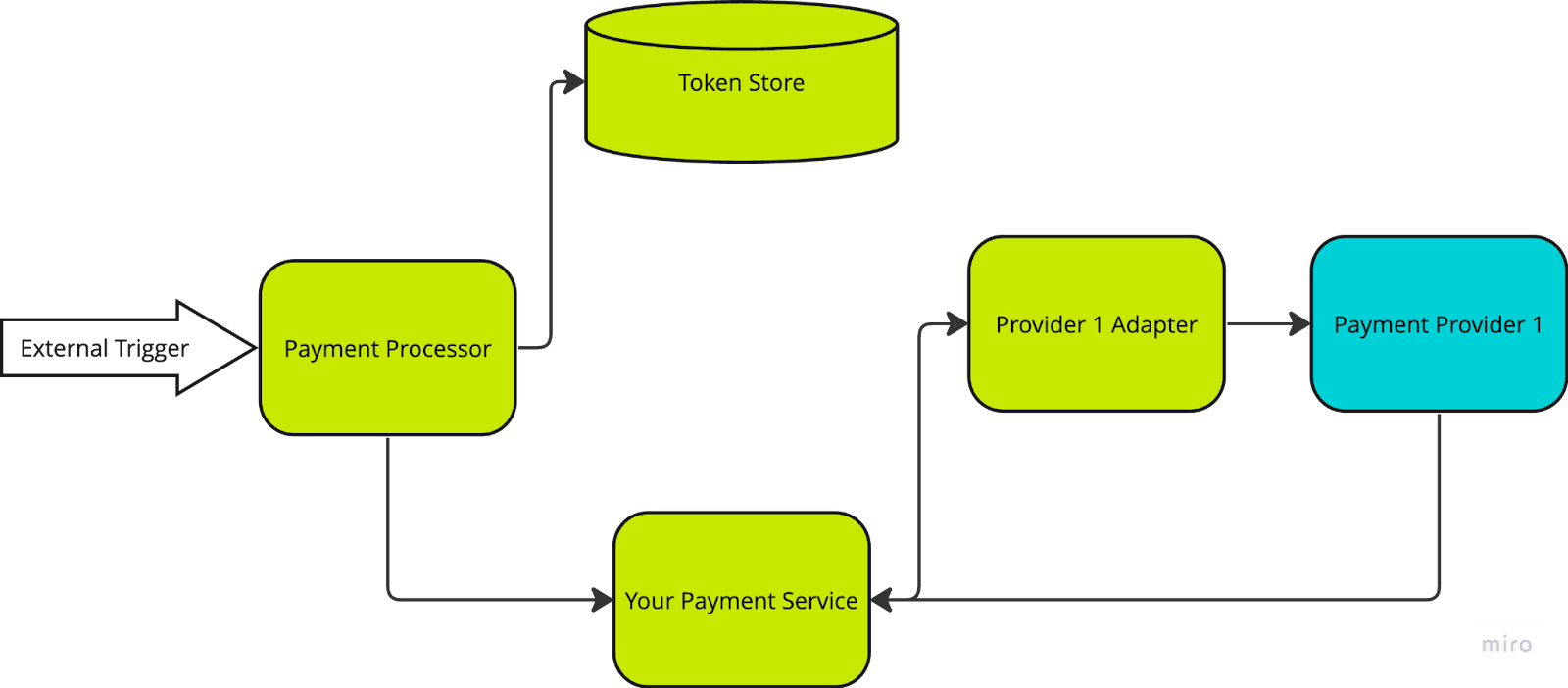

4. Use Async Processing

As transaction volumes in your app grow, it is recommended to switch to asynchronous payment processing. It is especially important for businesses with recurring billing, such as subscriptions.

This simplifies the process into two steps: authorizing the payment method and initiating a charge request using the token received during the authorization phase.

This method makes paying easier and gives you more options for handling a large volume of transactions.

The charging process can be done asynchronously, based on a timer or an external trigger.

5. Implement a Fallback Payment Option

Asynchronous payment processing creates a possibility of authorizing multiple payment methods for a single user. This flexibility allows for a fallback mechanism: if the primary payment method fails, the system can automatically attempt to charge one of the alternate payment methods.

This approach enhances the reliability of the payment process, ensuring transactions are successfully completed even if one payment method fails.

6. Putting It Together

This is how the complete architecture outline would look like when you complete all the steps above. You can start from here, see how it works for your business, iterate, and improve it with regard to your needs.

Final Thoughts

Striking the perfect balance between fast app development and its long-term sustainability is challenging, yet essential. The ideal proportion depends largely on your business needs.

A practical approach is to initially envision the future design and then progressively work towards it, ensuring that each step delivers tangible results.

Also, refactoring is an integral part of the scaling process, so it should be anticipated and planned for. To optimize the development process for both immediate and future success, it's important to understand which elements will require refactoring in upcoming iterations. This will allow us to minimize these needs in the current phase.

With that in mind, you can use the suggested approach and accommodate it to your application’s payment system in the most convenient way. Planning for growth and scalability from the very first development steps will build a solid foundation for an application that can be launched on any market and adapt to the changing and evolving payment preferences of your customers.

Opinions expressed by DZone contributors are their own.

Comments