Developing Peer-to-Peer Lending Platform on Blockchain

Get ready for the disruption in peer-to-peer lending process with the blockchain technology.

Join the DZone community and get the full member experience.

Join For FreeOver the last few years, blockchain has taken over global financial markets with its disruptive power to transform industries. While multiple sectors have experienced a positive impact on the blockchain, the lending market is ready to be a part of this transition.

Blockchain is all set to reconstruct the model of the peer-to-peer lending platform by bringing more trust and transparency to the system. Companies like SALT Lending, Lendoit, and Jibrel Network have already launched a peer-to-peer lending platform using blockchain and smart contracts.

But why do we need to implement the blockchain in peer-to-peer lending? What could be the pain points in the traditional lending process?

Here is the answer.

In a traditional lending process, people require intermediaries like a loan officer, banks, underwriter, and loan processor to build trust. But adding middlemen and regulations to the process of lending leads to the high fees.

Also, applying for a loan or credit can take a couple of weeks, and the rate of interests differ widely around the world. For example, the rate of interest for lending money in different countries like Algeria, Argentina, Bangladesh, the United States is 8 percent, 31.2 percent, 9.5 percent, and 4.8 percent respectively.

Using blockchain in peer-to-peer lending could help remove intermediaries from the current system. Let’s understand how P2P lending blockchain platform could help make the lending process more efficient.

- Cost Reduction: Blockchain could reduce costs by allowing borrowers to deal with lenders directly.

- Time: Blockchain could make the entire process quick by adding regulations in the smart contracts.

- The different rate of interest: The smart contracts could auto-generate the fixed rate of interests based on the profile of a borrower.

Blockchain could connect borrowers and lenders from all over the world through a decentralized platform. The entire P2P lending blockchain process could become seamless and trustworthy.

Stakeholders Involved in a P2P Lending Blockchain Platform:

- Lenders: a person who lends the money.

- Borrowers: a person who requests for a credit or loan with the intention of returning it within a certain duration of time.

- Guarantor: a person who takes the guarantee of a borrower requesting for the loan.

Here’s How a P2P Lending Blockchain Platform Could Work:

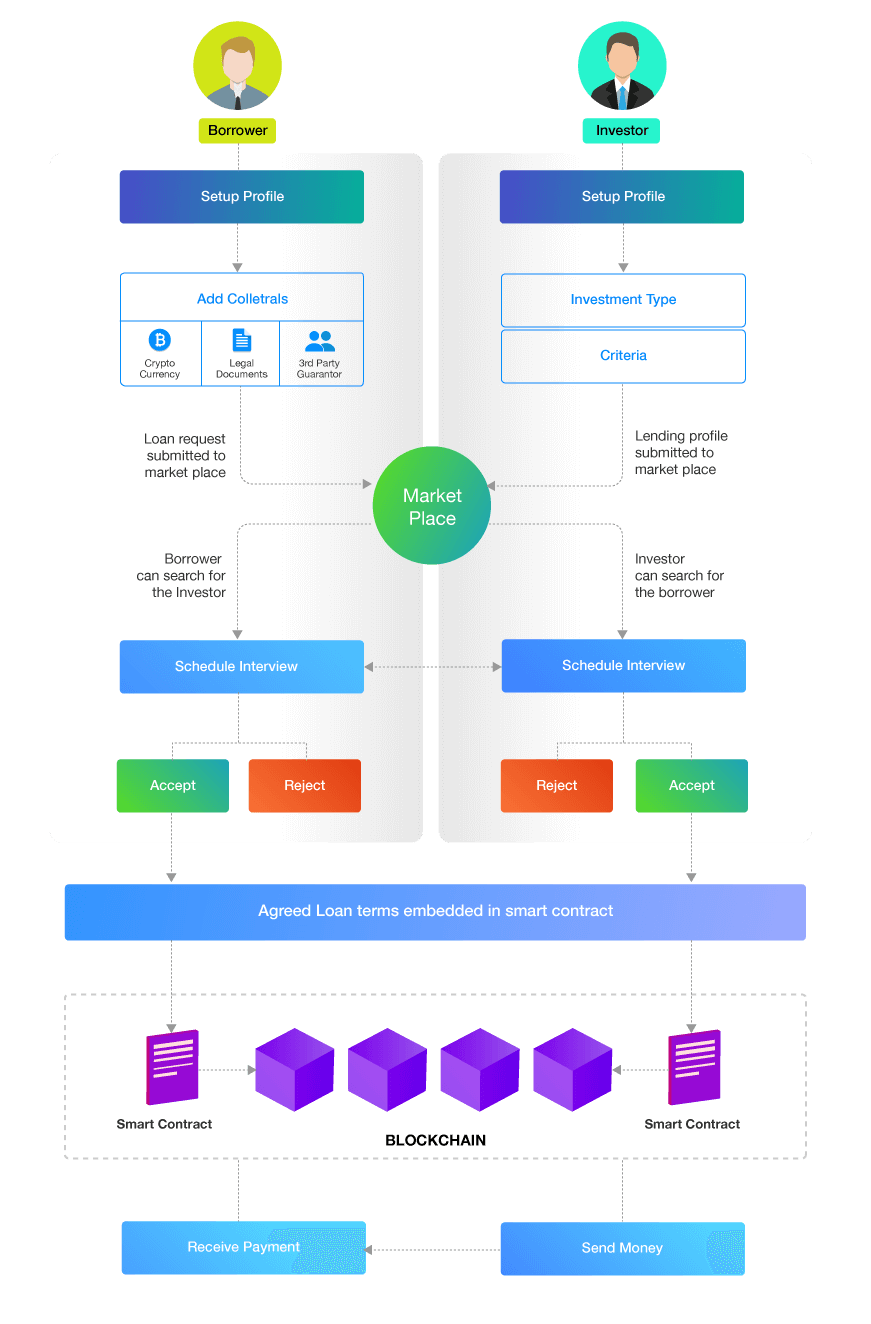

Image Source: LeewayHertz

Step 1: Lender Creates a Profile

The lender first creates a profile with the following:

- Personal information (name, address, and ID number)

- Bank account information

- Type of investment a lender wants to make. For example, a lender might wish to lend money to the borrowers requesting a loan for the business purposes.

- Criteria for different types of borrower, i.e. setting up the rate of interests according to the worthiness of a borrower.

The profile is submitted to the marketplace where lenders and borrowers could find each other.

Step 2 – Lender Waits for the Loan Requests

Once the account is successfully created, the lender waits for the loan requests from the borrower. As soon as any request is received, the lender schedules an interview with the borrower.

Step 3 – Borrower Creates an Account

A borrower setups an account with the following information:

- Personal information including name, address, and government-approved ID

- Collateral — crypto-coins, legal documents, and a guarantor.

Step 4 – Borrower Sends a Request for the Loan

After creating the account successfully, a borrower can send the loan request to all lenders around the world. Smart contracts allow borrowers to send loan requests to the lenders who are interested in the type of investment a borrower wants to make.

Step 5 – Lender Interviews the Borrower

After receiving the loan request, a lender interviews borrower and asks the following questions:

- Why do you want to take the loan?

- What is your monthly earning?

- What is your repayment rate?

- How many times have you applied for the credit in history?

A lender can either approve or reject the loan application based on the above questions.

Step 6 – Smart Contract Fixes the Rate of Interest

If the lender approves the loan request, the smart contract decides the fixed rate of interest for different types of borrowers by checking their creditworthiness.

The borrowers can be categorized as high-risk, medium-risk, or low-risk borrowers based on their repayment rates.

For example, lenders can set the low rate of interest for a low-risk borrower having good repayment rate.

Using a P2P lending blockchain platform, the rate of interests remain fixed all over the world.

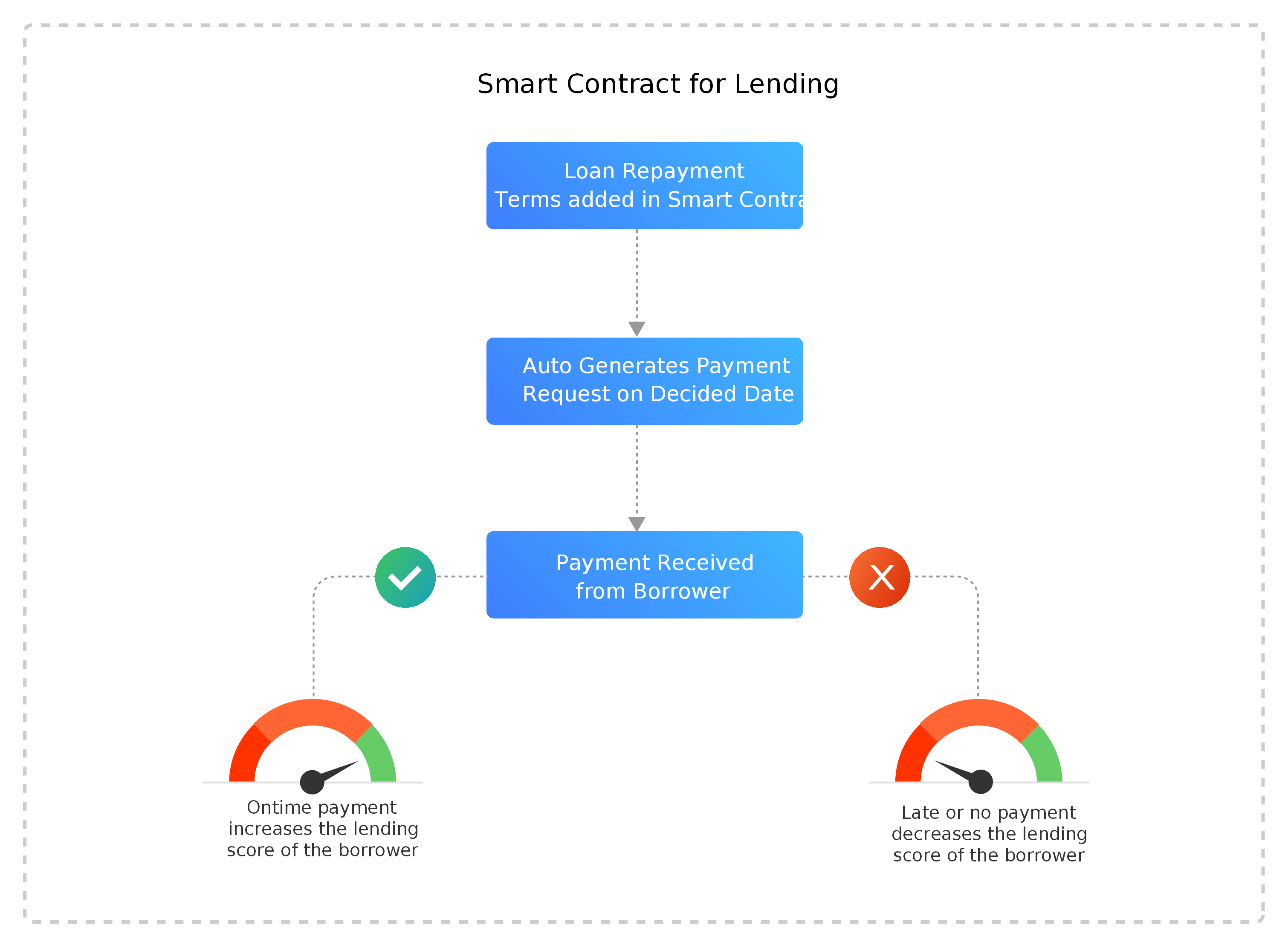

Step 7 – Auto-Payments Using Smart Contracts

Image Source: LeewayHertz

Borrowers can make the payments using smart contracts embedded with a crypto-wallet. If a borrower does not pay installments in a timely fashion, the smart contract adds late fees to the actual amount and upgrades it on the ledger.

So, if a borrower abides by the terms of the loan, the smart contract would automatically deduct penalties.

P2P lenders using blockchain can help reduce delays, make quick approvals, eliminate the need for middlemen, and bring transparency.

Blockchain-based P2P lending platforms allow investors to approve loans against residential properties, but the value of properties don’t remain stable always.

Moreover, the collateral provided by the borrower is not verified by a legal authority while lending money through the P2P platform. But the credibility can never be changed as smart contracts enable auto-payment and enforce compliances.

Either way, get ready for the disruption in peer-to-peer lending process with the blockchain technology.

Published at DZone with permission of Akash Takyar. See the original article here.

Opinions expressed by DZone contributors are their own.

Comments