Decoding DORA: EU's Unified Approach to ICT Risk Governance

The Digital Operational Resilience Act (DORA) aims to establish a unified framework for managing ICT risks in the EU financial sector.

Join the DZone community and get the full member experience.

Join For FreeAs financial services become increasingly digitized, the need for robust operational resilience has grown more critical. The Digital Operational Resilience Act (DORA), set to take effect on January 17, 2025, aims to establish a unified framework for Information and Communication Technology (ICT) risk management across the European Union's financial sector. This new regulation will significantly impact how banks, insurers, and other financial entities approach their digital risks.

DORA represents an important step in regulatory evolution, designed to address the growing complexities of the digital financial landscape. But what does this mean for financial institutions? And how can organizations prepare for this shift in regulatory expectations?

The Digital Operational Resilience Act (DORA) marks a significant shift in the European Union's approach to managing Information and Communications Technology (ICT) risks in the financial sector.

Understanding DORA's Scope and Objectives

DORA casts a wide net, covering not just traditional banks and insurers, but also fintech startups, crypto-asset service providers, and critical ICT third-party service providers. This inclusive approach reflects the interconnected nature of modern finance and the need for a holistic view of digital risk.

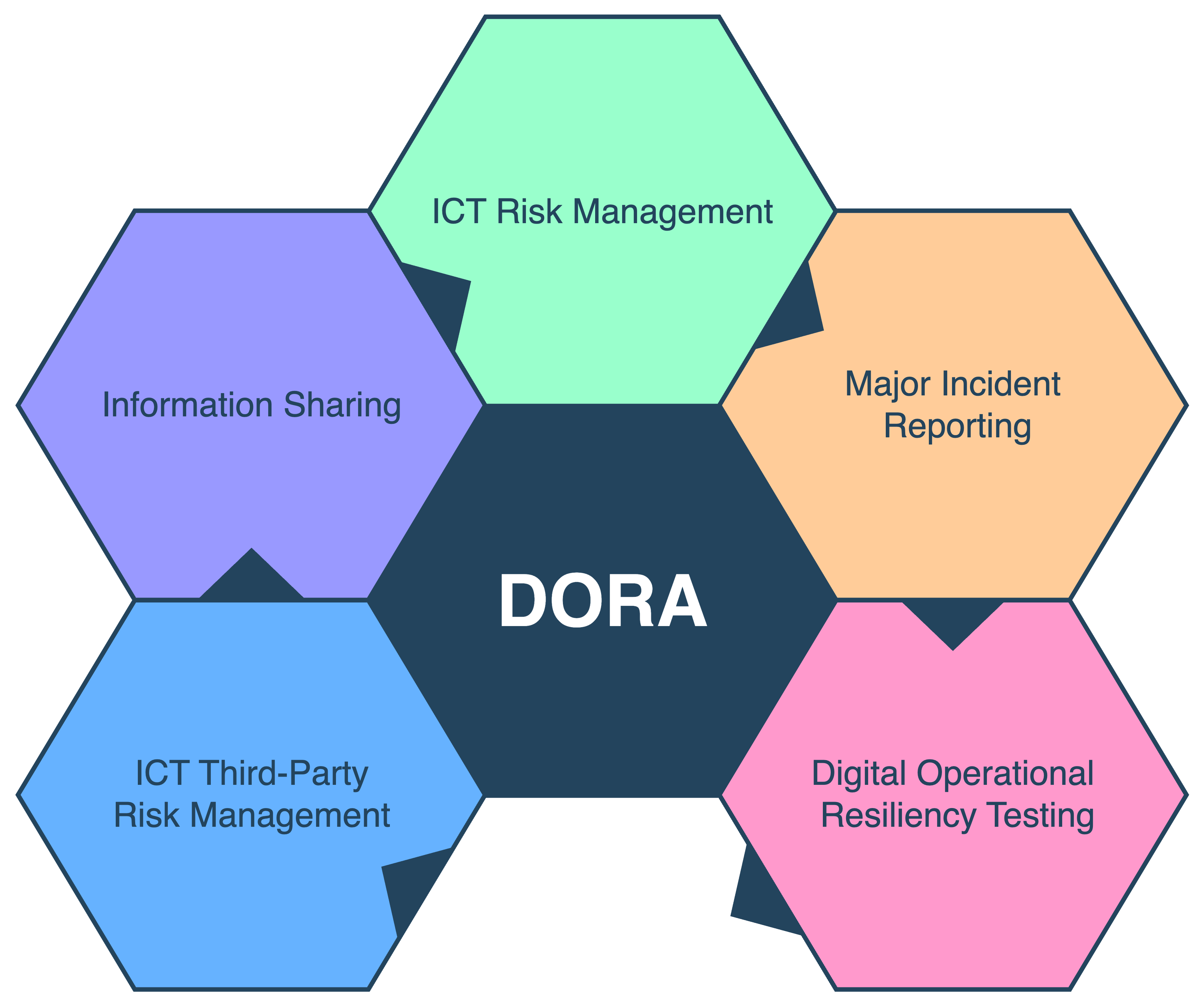

The regulation focuses on five key areas:

- ICT Risk Management: Requires financial entities to implement and maintain resilient ICT systems, with continuous risk identification and mitigation

- Major Incident Reporting: Establishes a harmonized reporting framework for significant ICT-related incidents, ensuring quick notification to relevant authorities

- Digital Operational Resilience Testing: Mandates regular testing of ICT systems, including advanced threat-led penetration testing for larger institutions

- ICT Third-Party Risk Management: Introduces strict requirements for managing relationships with ICT service providers, including an oversight framework for critical providers

- Information Sharing: Encourages the exchange of cyber threat intelligence among financial entities

DORA aims to consolidate and upgrade ICT risk requirements, ensuring all firms are subject to a common set of standards to mitigate ICT risks. It's designed to reduce regulatory complexity and lower financial and administrative burdens caused by the current patchwork of regulations.

Implementation Challenges and Considerations

The regulation demands a fundamental shift in how organizations approach digital resilience. One of the biggest challenges is the need for cross-functional collaboration. DORA touches on areas traditionally siloed within organizations: IT, risk management, compliance, and even the board. Breaking down these silos and fostering a culture of shared responsibility for digital resilience is proving to be a significant hurdle for many enterprises.

Another key aspect is the oversight framework for critical ICT third-party service providers. DORA introduces a mechanism to designate certain providers as "critical" and subjects them to direct oversight by EU authorities.

This is a novel approach that extends regulatory reach beyond financial entities to their key technology providers.

The Oversight Framework and Its Implications

The Oversight Framework is a cornerstone of DORA, designed to address the systemic risk posed by the financial sector's reliance on a small number of critical ICT service providers. Key features include:

- Designation mechanism: Criteria will be established to identify which ICT third-party service providers are "critical" to the EU financial sector.

- Lead overseer: One of the European Supervisory Authorities (EBA, EIOPA, or ESMA) will be assigned as the Lead Overseer for each critical ICT third-party service provider.

- Powers of the lead overseer: These include conducting investigations, onsite and offsite inspections, and issuing recommendations.

- EU presence requirement: Critical ICT third-party service providers based outside the EU will need to establish a subsidiary within the EU within 12 months of designation.

- Penalties for non-compliance: The framework includes the power to impose fines for failure to comply with oversight requirements.

Practical Steps Towards DORA Compliance

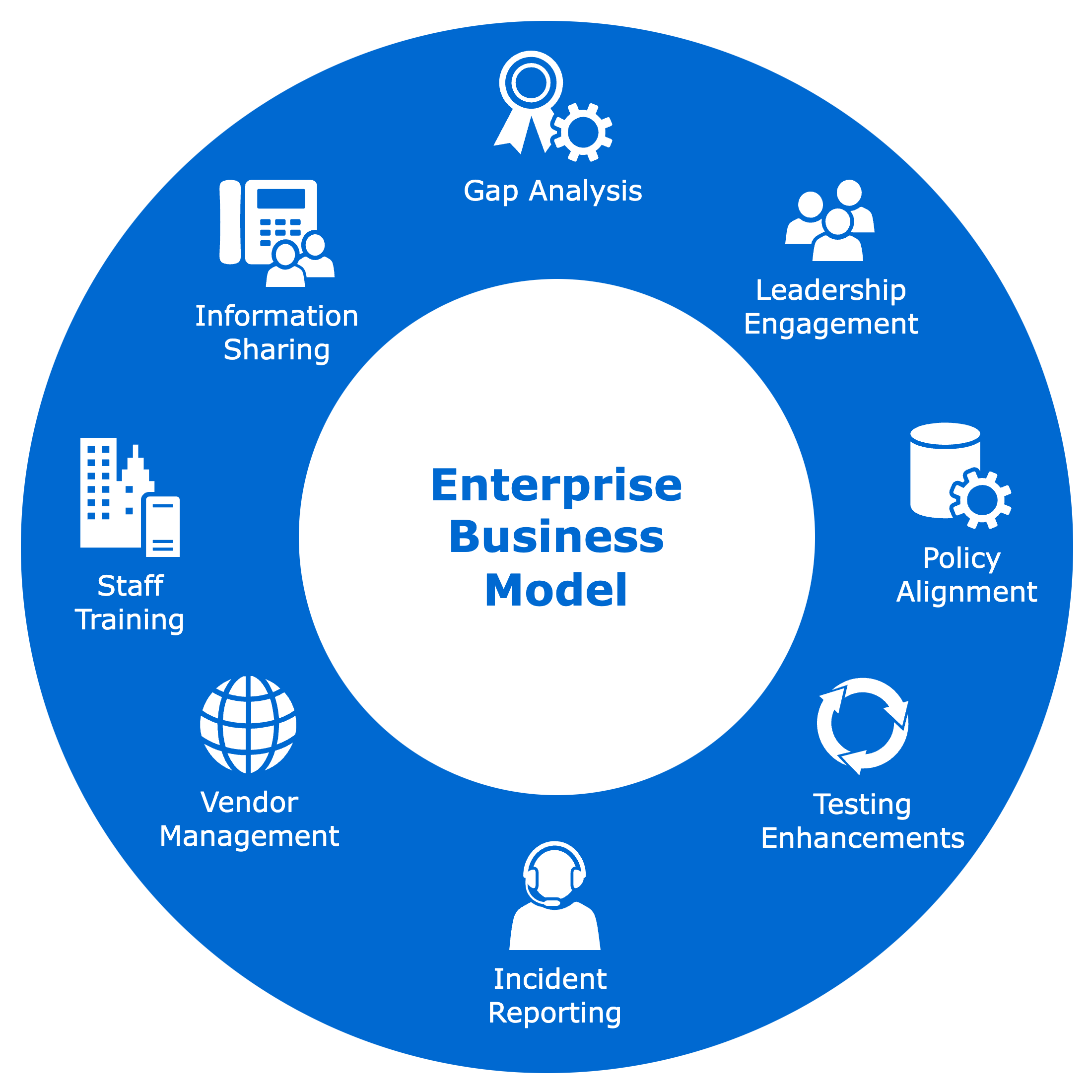

Financial institutions can take several steps to prepare for DORA. The most important ones are listed below.

- Conduct a comprehensive gap analysis comparing current ICT risk management practices against DORA's requirements.

- Engage the board and senior management, ensuring they understand their responsibilities under DORA, including the need for ongoing oversight and risk awareness.

- Review and update policies, particularly incident response plans and third-party risk management procedures, to align with DORA's specific requirements.

- Invest in testing capabilities, including advanced threat-led penetration testing for larger institutions, and establish a regular testing schedule.

- Enhance incident reporting processes to meet DORA's strict timelines, including the ability to provide initial, intermediate, and final reports on major incidents.

- Collaborate closely with ICT third-party service providers to ensure their readiness and compliance, including reviewing and updating contracts as necessary.

- Develop and implement a comprehensive training program to ensure staff at all levels understand their role in maintaining digital resilience.

- Establish or enhance information sharing mechanisms to participate in the exchange of cyber threat intelligence with other financial entities.

Looking Ahead: DORA's Potential Global Impact

While DORA is an EU regulation, its impact is likely to be felt globally. Many international financial institutions will need to comply with DORA for their EU operations, potentially leading them to adopt similar standards worldwide for consistency. Furthermore, regulators in other jurisdictions are watching DORA closely, and similar regulations may emerge in other financial centers in the coming years.

The regulation may also influence how financial institutions approach digital resilience beyond regulatory compliance, potentially driving a more proactive and comprehensive approach to ICT risk management across the industry.

Conclusion: Embracing Digital Resilience as a Business Imperative

The following is the timeline associated with DORA as of writing this article:

As we approach the January 2025 deadline, it's clear that DORA represents both a challenge and an opportunity for the financial sector. While compliance will require significant effort and investment, the payoff — a more resilient, trustworthy financial system — is substantial.

Treat DORA not just as a regulatory requirement, but as a catalyst for building true digital resilience.

In our increasingly digital world, operational resilience is no longer just a compliance issue - it's a fundamental business imperative that can provide a competitive advantage in an increasingly complex and interconnected financial ecosystem.

Opinions expressed by DZone contributors are their own.

Comments