Cloud Computing's Role in Transforming AML and KYC Operations

This article will explore the impact of cloud computing on Anti-Money Laundering (AML) and Know Your Customer (KYC) operations within financial institutions.

Join the DZone community and get the full member experience.

Join For FreeThe onset of the COVID-19 pandemic in 2019 marked a pivotal moment in human history, presenting unprecedented challenges that extended beyond healthcare into the realms of psychology, economics, and various industrial sectors. High-contact services, including education, retail, foodservice, and notably the banking and financial sector, were significantly impacted.

This paradigm shift in human behavior, characterized by a transition to remote environments and increased teleworking, inadvertently created new avenues for financial crimes, intensifying the workload for compliance teams. Financial institutions, traditionally reliant on legacy IT infrastructures and disparate web applications, faced considerable operational and regulatory risks. These archaic systems, scattered across multiple platforms, resulted in inefficiencies and a fragmented customer view, compounded by the challenges of remote access to secure legacy systems.

However, the pandemic also catalyzed technological innovation, accelerating the adoption of cloud migrations, a concept previously on the agendas of many CIOs but not urgently pursued. The transition to cloud computing offered agility, resilience, data centralization, and a shift from operational expenditure models to capital expenditure models, compelling businesses to embrace cloud solutions. The shift from Opex models to Capex was among the most captivating factors for businesses to adopt the cloud. This shift was particularly relevant in the context of Anti-Money Laundering (AML) and Know Your Customer (KYC) operations.

Shared responsibility models enable financial institutions to offload major tasks such as management of storage, compute power, networking, database operations, and system availability to the cloud provider while taking on the charge for network encryptions and data security. This takes a big burden off financial institutions to be more lean with their IT costs and more effective in removing the perils of remote work and network issues. FIs can therefore focus more on their core functions — banking, insurance, and compliance checks — than be at the mercy of their internal IT operations, which can inherently be more expensive to maintain than the cloud cost.

Case Study: Barclays Bank's Cloud Transformation

Barclays Bank, a global financial services provider, offers a relevant case study illustrating the transformative impact of cloud computing in AML and KYC operations. Faced with the challenges of the pandemic, Barclays accelerated its cloud adoption, migrating significant portions of its data and applications to the cloud.

The bank utilized cloud services for centralized data storage, which greatly enhanced its ability to conduct comprehensive AML and KYC checks. By leveraging cloud-based analytics and machine learning models, Barclays improved its ability to detect and prevent financial crimes. This shift not only streamlined compliance processes but also offered greater scalability and flexibility in handling large volumes of transactions and customer data.

Furthermore, Barclays' collaboration with cloud providers enabled the development of more sophisticated AML tools, integrating real-time monitoring and predictive analytics into its compliance framework. This strategic move reduced operational costs and significantly improved the efficacy of its AML and KYC operations.

The biggest advantage is data centralization. Data is not scattered in different systems which allows compliance investigators to get a holistic view of information about a customer in one place and thereby speed the investigation process and decision-making. Cloud platforms allow for seamless storage at very low cost and also enable organizations with a lot more querying and analytical toolsets. This further aids in the compliance investigation process as the AML investigator gets a view of all the transactions and the trends analysis much faster.

AML platform providers were also coaxed to shift from typical on-premise solutions to creating cloud-based platforms which could then be mere plug-and-play SaaS solutions for the FIs. These enabled real-time monitoring of transactions thus alerting of any suspicious activity almost immediately. Unified AML platforms on the cloud also allow collaboration across the AML process chain and the overall FI ecosystem. This happened because the cloud platform enables secure data sharing not just on AML solutions but across the FI which facilitates faster information exchange.

The next big jump is taking advantage of the various artificial intelligence (AI) services which cloud services provide. Standardized machine learning models can be developed, trained extensively with data, and be used to produce repeatable and predictable results. Establishing patterns and behavior trends would become easier, resulting in faster policing of criminal financial activities.

How Can Software Developers Leverage Cloud and AI for AML and KYC?

For developers in the financial sector, the integration of cloud computing and AI offers a rich landscape for innovation. Key areas of focus include:

Developing Cloud-Based AML/KYC Solutions

Utilizing cloud platforms like AWS, Azure, or Google Cloud, developers can build scalable and flexible AML/KYC applications. These platforms provide robust APIs, SDKs, and services for data storage, analysis, and machine learning.

Implementing Machine Learning Models

Developers can leverage cloud-based machine learning services to develop models that identify patterns indicative of fraudulent activity. These models can be trained on large datasets, continuously learning and improving their accuracy.

API Integration and Microservices Architecture

The microservices architecture in cloud environments allows for modular development and easy integration of various services, such as identity verification, transaction monitoring, and customer risk assessment.

Data Security and Privacy Compliance

Ensuring data security and adhering to privacy regulations like GDPR is paramount. Developers must implement encryption, access controls, and regular audits to maintain data integrity and compliance.

Real-Time Analytics and Reporting

Developing systems for real-time analytics and reporting can significantly enhance AML/KYC processes, enabling timely detection and reporting of suspicious activities.

By focusing on these areas, developers can contribute significantly to the evolution of AML and KYC operations in the financial sector, leveraging the power of cloud computing and AI.

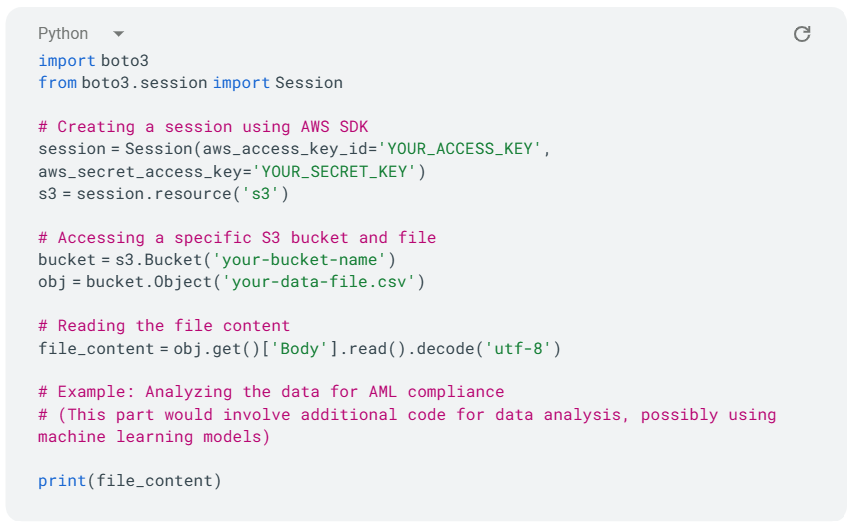

Relevant AI-Cloud Integration Example

To illustrate the integration of AI and cloud computing in AML and KYC operations, consider a Python code snippet using AWS SDK for Python (Boto3), which demonstrates how to access and analyze data stored in the cloud:

Conclusion

The challenges posed by the COVID-19 pandemic presented an opportunity for technological transformation within the financial industry, leading to the emergence of a more technologically adept Fintech sector, reduced operational costs, accelerated AML detection, and enhanced KYC processes. The case of Barclays Bank exemplifies this transformation, underscoring the significant role that cloud computing and AI play in modernizing financial compliance operations.

Opinions expressed by DZone contributors are their own.

Comments