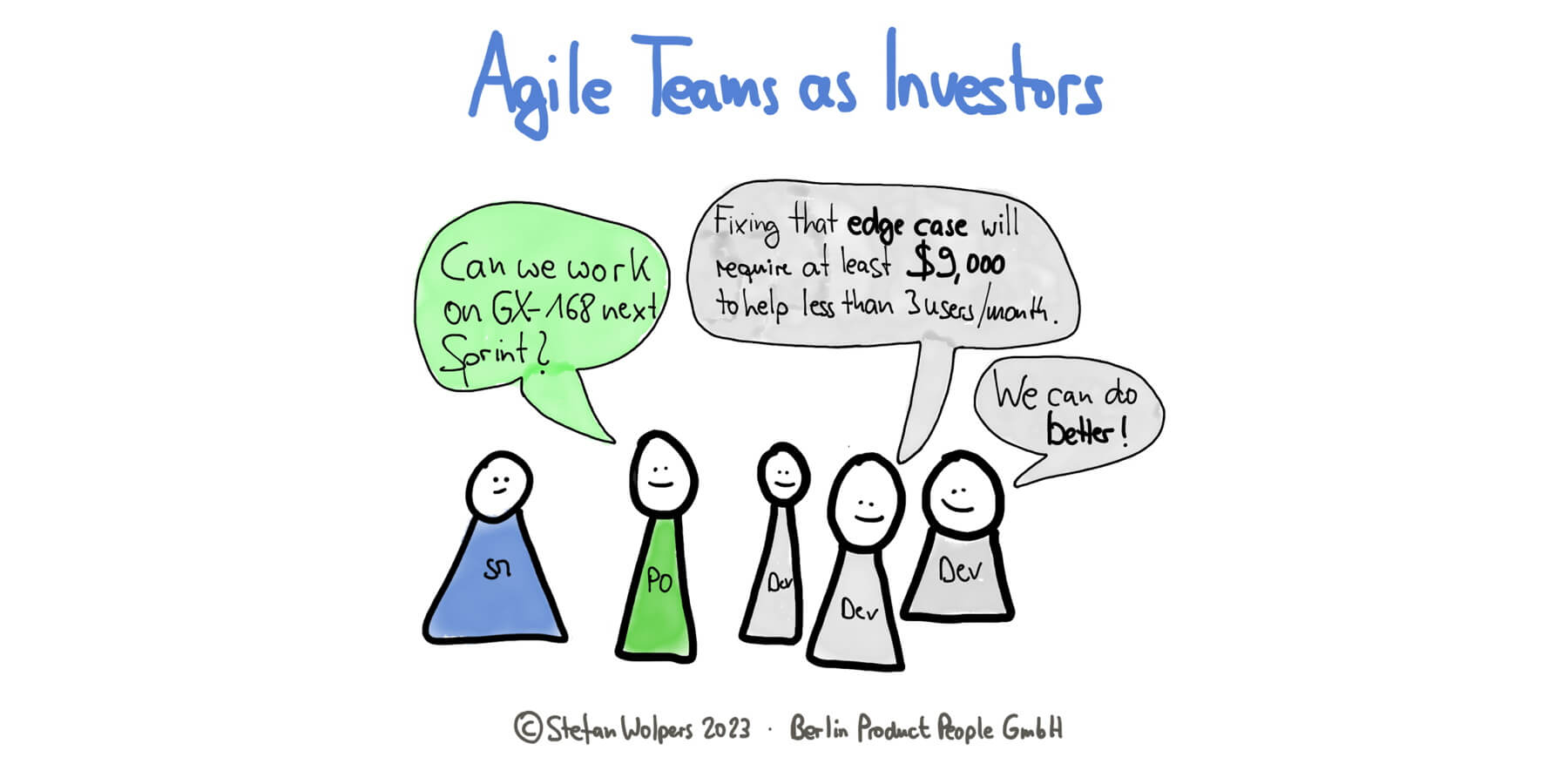

Agile Teams as Investors

A deeper dive into maximizing organizational value by trusting your teams to find solutions to your customers' problems.

Join the DZone community and get the full member experience.

Join For FreeStakeholders often regard Scrum and other Agile teams as cost centers, primarily focused on executing projects within budgetary confines. This conventional view, however, undervalues their strategic potential. If we reconsider Agile teams as investors — carefully allocating their resources to optimize returns — they can significantly impact an organization’s strategic objectives and long-term profitability.

This perspective not only redefines their role but also enhances the effectiveness of their contributions to the business by solving the customers’ problems.

Strategic Benefits of Viewing Agile Teams as Investors

Viewing Agile teams merely as task executors or internal development agencies misses a significant opportunity to harness their strategic potential.

Instead, when we envision these Agile teams as investors within the organization’s strategic framework, their role undergoes a radical transformation. This shift in perspective not only emphasizes the intrinsic value Agile teams contribute but also ensures that their daily activities directly support and drive the company’s broader financial and strategic objectives.

The following article will explore the multiple strategic benefits of adopting this investor-like viewpoint for Agile teams. For example, by treating each Sprint as a calculated investment with measurable returns, organizations can foster a more dynamic, responsive, and profitable development environment, maximizing operational efficiency and business outcomes.

The advantages of such a viewpoint are apparent:

- Dynamic allocation of resources: Agile teams prioritize work that promises the highest return on investment (ROI), adjusting their focus as market conditions and customer needs evolve. This dynamic resource allocation is akin to managing a flexible investment portfolio where the allocation is continuously optimized in response to changing externalities.

- Cultivation of ownership and accountability: Teams that view their roles through an investor lens develop a more profound sense of ownership over the products they build. This mindset fosters a culture where every resource expenditure is scrutinized for value, encouraging more thoughtful and result-oriented work and avoiding typical blunders such as gold plating.

- Alignment with organizational goals: The investor perspective also helps bridge the gap between Agile teams and corporate strategy. It ensures that every Sprint and every project contributes directly to the organization’s overarching goals, aligning day-to-day activities with long-term business objectives. There is a reason why Scrum introduced the Product Goal with the Scrum Guide 2020.

Investor Mindset Within Agile Frameworks

When Agile teams operate as investors, they manage a portfolio of product development opportunities, each akin to a financial asset. This paradigm shift necessitates a robust understanding of value from a product functionality standpoint and a market and business perspective.

Every decision to pursue a new feature, enhance an existing product, or pivot direction is an investment decision with potential returns measured in customer satisfaction, market share, revenue growth, and long-term business viability.

Supportive Practices for Agile Teams as Investors

To harness the full potential of Agile teams as investors and maximize the returns on their investments, organizations must create a conducive environment that supports this refined role. The following practices are crucial for empowering Agile teams to operate effectively within this concept:

- Autonomy within guided parameters: Similar to how a fund manager operates within the confines of an investment mandate, Agile teams require the freedom to make decisions independently while adhering to the broader strategic objectives set by the organization. This autonomy empowers them to make quick, responsive decisions that align with real-time market conditions and customer feedback. Leaders must trust these teams to navigate the details, allowing them to innovate and adjust their strategies without micromanagement. Agile teams as investors require agency with known constraints.

- Emphasis on continuous learning: The “investment realm” is dynamic, with continuous shifts that demand ongoing education and adaptability. Agile teams similarly benefit from a continuous learning environment where they can stay updated on the latest technological trends, market dynamics, and customer preferences. This knowledge is critical for making informed decisions, anticipating market needs, and responding proactively. Organizations should facilitate this learning by providing access to training, workshops, and industry conferences and encouraging knowledge sharing within and across teams, for example, by hosting events for the Agile community.

- Transparent and open communication: Effective communication channels between Agile teams and stakeholders are essential for understanding project expectations, organizational goals, and resource availability. This transparency helps teams make informed decisions about where to allocate their efforts for the best possible returns. Therefore, Agile teams should collaborate with stakeholders and establish regular check-ins, such as Sprint Reviews, Retrospectives, and joint exercises and workshops, to ensure all stakeholders are on the same page and can provide timely feedback that could influence investment decisions.

- Strategic resource allocation: Just as investors decide how best to distribute assets to maximize portfolio returns, Agile teams must strategically allocate their time and resources. This involves prioritizing tasks based on their potential impact and aligning them with the organization’s key performance indicators (KPIs). Multiple tools, such as value stream mapping or user story mapping, can help identify the most valuable activities that contribute directly to customer satisfaction and business success.

- Risk management and mitigation: Risk management and mitigation are paramount in the investment world. Agile teams, too, must develop competencies in identifying, assessing, and responding to risks associated with their projects. For example, working iteratively and incrementally in Scrum helps to quickly create feedback loops and adjust course if Increments do not live up to the anticipated response, preventing the team from pouring more time into something less valuable, diluting the potential ROI of the team. (Typically, risk mitigation starts even earlier in the process, based on product discovery and refinement activities.

- Performance metrics and feedback loops: To understand the effectiveness of their investment decisions, Agile teams need robust metrics and feedback mechanisms to guide future improvements. Metrics such as return on investment (ROI), customer satisfaction scores, and market penetration rates are valuable in assessing the success of Agile initiatives. Establishing a culture of feedback where insights and learning from each project cycle are systematically collected and analyzed will enable teams to refine their approaches continually, hence the importance of Sprint Reviews and Retrospectives in Scrum for optimizing a team’s contributions to the company’s strategic goals and ensuring sustained business growth and agility.

Top Ten Anti-Patterns Limiting Agile Teams as Investors

It could all be so simple if it weren’t for corporate reality. Despite the usefulness of Agile teams as investors concept, teams typically face numerous obstacles.

Consequently, identifying and addressing these anti-patterns is crucial for Agile teams to succeed. Here, we explore the top ten anti-patterns that can severely restrict Agile teams from maximizing their investment capabilities and suggest strategies for overcoming them:

- Siloed operations: When teams operate in silos, they miss critical insights from other parts of the organization that could influence strategic decisions. To break down these silos, promote cross-functional teams and encourage regular interdepartmental meetings where teams can share insights and collaborate on broader organizational goals. Open Spaces or Barcamps are a good starting point.

- Rigid adherence to roadmaps: While roadmaps help guide development, strict adherence can prevent teams from adapting to new information or capitalizing on emerging opportunities. Implementing a flexible roadmap approach, where adjustments are possible and expected, can help teams stay Agile and responsive.

- Short-term focus: Focusing solely on short-term outcomes can lead to decisions that sacrifice long-term value. Encourage teams to adopt a balanced scorecard approach that includes short-term and long-term goals, ensuring immediate achievements do not undermine future success.

- Insufficient stakeholder engagement: Agile teams often lack deep engagement with stakeholders, leading to misalignments and missed opportunities. To combat this, develop structured engagement plans that include regular updates and involvement opportunities for stakeholders throughout the product lifecycle, starting with Sprint Reviews, stakeholder Retrospectives, and collaborative workshops and exercises.

- Aversion to risk: A culture that penalizes failure stifles innovation and risk-taking. Establishing a risk-tolerant culture that rewards calculated risks and views failures as learning opportunities can encourage teams to pursue higher-return projects. Leadership needs to lead this effort — no pun intended — by sharing their experiences; “failure nights” are suitable for that purpose.

- Resource hoarding: When teams withhold resources to safeguard against uncertainties, it prevents those resources from being used where they could generate value. Encourage a culture of transparency and shared responsibility where resources are allocated based on strategic priorities rather than preserved for hypothetical needs.

- Neglect of technical debt: Ignoring technical debt can increase costs and reduce system efficiency in the long run. Task the Agile team to maintain technical excellence and allocate time for debt reduction in each Sprint, treating these efforts as critical investments in the product’s future. There is no business agility without technical excellence.

- Mismatched incentives: When team incentives, or, worse, personal incentives, are not aligned with organizational goals, it can lead to misdirected efforts. Align reward systems with desired outcomes, such as customer satisfaction, market growth, or innovation metrics, to ensure that everyone’s efforts contribute directly to business objectives.

- Poor market understanding: Teams cannot make informed investment decisions without a strong understanding of the market and customer needs. Invest in market research and customer interaction programs to keep teams informed and responsive to the external environment. All team members must participate in product discovery and customer research activities regularly.

- Resistance to organizational change: Resistance to new methodologies, practices, or tools can limit a team’s ability to adapt and grow. Foster a culture of continuous improvement and openness to change by regularly reviewing and updating practices and providing training and support for new approaches.

By addressing these anti-patterns, organizations can empower their Agile teams as investors, making smarter decisions that align with long-term strategic goals and enhance the company’s overall market position.

Conclusion

In conclusion, reimagining Scrum and Agile teams as investors is not merely a shift in perspective but a transformative approach that aligns these teams more closely with the organization’s broader objectives. By viewing every Sprint and project through the investment lens, these teams are empowered to prioritize initiatives that promise the best returns regarding customer value and contributions to the organization’s success.

This investor mindset encourages Agile teams to operate with an enhanced sense of ownership and accountability, making decisions that are not just beneficial in the short term but are sustainable and profitable over the long haul. It fosters a deeper level of strategic engagement with projects, where Agile teams are motivated to maximize efficiency and effectiveness, understanding their direct impact on the company’s performance.

Moreover, the practices that support Agile teams as investors—such as granting autonomy, emphasizing continuous learning, and ensuring open communication—are foundational to creating a culture of innovation and responsiveness. These practices help break down silos, encourage risk-taking, and align team incentives with corporate goals, driving the organization forward in a competitive marketplace.

It is critical to address the common anti-patterns that hinder this investment-centric approach. By actively working to eliminate these barriers, organizations can unlock the true potential of their Agile teams, transforming them into critical drivers of business value and strategic advantage.

Ultimately, when Scrum and Agile teams are empowered to act as investors, they contribute not only to the immediate product development goals but also to the long-term viability and growth of the organization. This holistic integration of Agile practices with business strategy ensures that the investments made in every Sprint yield substantial and sustained returns, securing a competitive edge in the dynamic business landscape.

Do you view your Agile teams as investors? Please share with us in the comments.

Published at DZone with permission of Stefan Wolpers, DZone MVB. See the original article here.

Opinions expressed by DZone contributors are their own.

Comments